MD NIPCO Plc, M. Suresh Kumar (left) with Board Chairman, Bestman Anekwe, and Company Secretary/Legal Adviser, Paul Obi, at the AGM in Abuja on Wednesday.

After over 19 year of operations, NIPCO Plc is focused on becoming Nigeria’s petroleum product marketing company of choice, its Chairman, Bestman Anekwe, has said.

Anekwe who addressed shareholders at the 19th Annual General Meeting of the company held at the Abuja Continental Hotel attributed his optimism to the prudent management of the human and material resources which has made NIPCO Plc tower above its peers in the hydrocarbon industry

A non-executive director, who is also the Chairman of the core investor in the company, Ramesh Kansagra, re-echoed Anekwe’s optimism, noting that despite the myriad of challenges in the Nigerian economy, NIPCO Plc has been able to establish itself as a downstream petroleum industry operator to reckon with, in terms of value addition to the economy and its shareholders.

Kansagra, who spoke to shareholders at the meeting from London through Zoom, said after 19 years in business since 2004, NIPCO Plc has largely achieved its vision, although much still remained to accomplish to get to where the company wants to be.

He thanked the investors and shareholders who have entrusted the company in their management, assuring that with what the company is currently doing it would become the leading company in Nigeria in the next fear years.

“When the company started operations in 2004, the vision of the management was to see NIPCO emerge as the leading petroleum products marketing company in Nigeria. Today, we have achieved a lot towards realising that vision. However, it is clear we still have a long way to go to get to where we really want to be in future,” he said.

On the request by the shareholders for higher dividend, Kansagra defended the decision by the management of the company to focus on investing of the development of operational infrastructure, arguing that high dividend paying companies were those who lacked the capacity to pursue their growth agenda.

Apart from the company’s investments to upgrade the infrastructure to make for its effective operations, he said NIPCO has over the years diversified its portfolio into other areas, including the hospitality sector, in addition to consistently paying dividends to shareholders.

He assured shareholders that NIPCO was growing on the right path set for itself, while appreciating that the company was still on a long journey to where it wants to be.

“Because of the current economic crisis in the country, the interest rate charged by banks on loans are very high. If the company was to borrow from the banks to carry out most of the investments it has embarked upon, it would have spent a huge amount of its resources on the repayment of the loans.

“Also, rather than take money directly from the shareholders, the management decided to look inwards to rely on its available profits for the investments it decided to pursue, which are very visible for all to see,” he explained.

He pleaded with shareholders for patience, saying these investments have high prospects of yielding dividends for the benefit of all the investors who have toiled and stood by the management despite the difficult economic climate.

The Managing Director of the company, M. Suresh Kumar, who spoke on steps to take NIPCO to the next level, said 2022 was a difficult year for business due to the challenges posed by the global economic crisis as a result of the Russia-Ukraine war.

Kumar said the adverse impact of the global crisis on the Nigerian economy affected the country’s reliance on products imports leading to skyrocketing prices due to the ban in the procurement of petroleum products from Russia.

He identified other challenges that plagued the industry to include paucity of foreign e, change to import deregulated petroleum products, Naira volatility, and frequent freight increases.

The resultant effect of these challenges, he pointed out, was the declining margins on petroleum products due to rising cost of operations.

With the enactment of the PIA and the drive by the government to deepen gas utilisation in line with the global energy transition agenda, the MD said the company’s wholly-owned subsidiary, NIPCO Gas Limited, embarked on a number of investments to promote domestic gas utilisation.

The investments, he said, were on gas infrastructure to provide access to both compressed natural gas for auto use and piped natural gas for industrial usage.

Apart from constructing over 100 kilometers of big gas pipelines in the Lagos-Ibadan expressway linking Ogun to neighbouring Oyo state via gas pipeline, he said the company has also constructed three CNG refill stations in Abuja and environs to facilitate access to gas by motorists and other users.

He assured that the company would continue to invest in the hydrocarbon industry as a demonstration of its continued commitment and belief in the resilience of the Nigerian economy.

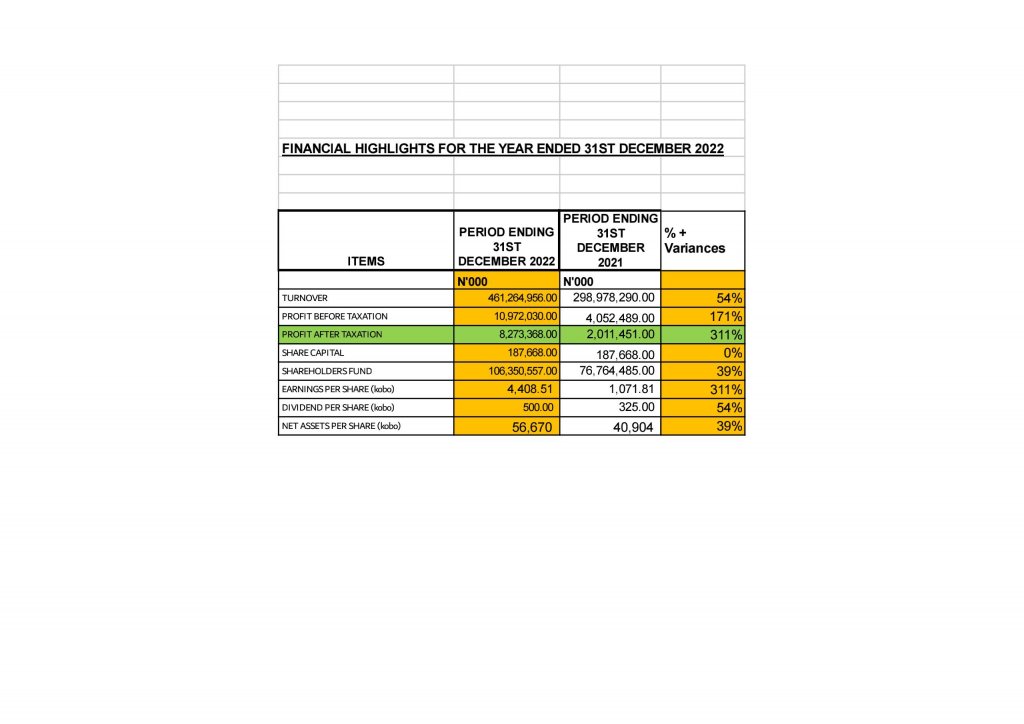

Highlights of the company’s financial performance for the year ended December 31, 2022 showed that turnover grew by 54 percent, from N298.98bn in 2021 to N461.27bn, while profit after tax climbed by 311 percent, from N2.01bn to N8.27bn.

During the meeting, shareholders approved N500 as dividend payable per share held by investors whose names appeared in the company register as at December 31, 2022.

Earlier, the company secretary, Paul Obi, told the shareholders that over the last 19 years, a lot of the company’s resources have been capitalised through massive investments in the development of strategic capital projects.

On the issue of unclaimed dividends by shareholders, Obi assured that the matter would be resolved within the next one month, as the company has commenced the process pay all the outstanding dividends to shareholders in compliance with the regulations by the Securities and Exchange Commission (SEC).

Following the issuance of NIPCO shares 2003, he recalled that the bulk of the investors were IPMAN members who were among the over 5000 marketers from the 21 different depots that contributed to the fund from across the country, while the direct shareholders were about 1800 investors.

He said NIPCO management has commenced the process of getting those shares issued directly to marketers in all the depots, with all the accumulated dividends for investors in the depots in the northern part of the country already settled, along with 90 percent of those in the South-West region.

The Secretary said attention was now focused on settling the over 1000 marketers in the Southern region, including over 500 from the South-east zone, assuring that all the accumulated dividends due to investors in the region would be paid out within the next 22 days to one month.

He expressed confidence that by next annual general meeting, about 75 percent of the outstanding dividends to investors would have been paid out.

Echoing the views of most other shareholders who spoke during the meeting, a Senator representing Enugu Federal Constituency in the National Assembly, Okechukwu Ezea, commended the Board and management of the company for their frugal management of the company’s resources, particularly the decision to invest in the acquisition of assets for the company, including the iconic Abuja Continental Hotel.

He urged shareholders to see reason in the explanation by the Board and management that the dividend payment to them during this financial year was not as much as it should have been apparently because the bulk of the profit were deployed into investments to grow the business rather than resort to borrowing from the banks at high interest rate for such purposes.