By Bassey Udo

The outgoing Buhari administration may be leaving behind a total debt stock of about N72 trillion by the time it will exit office on May 29 this year, projections by the Debt Management Office (DMO) have revealed.

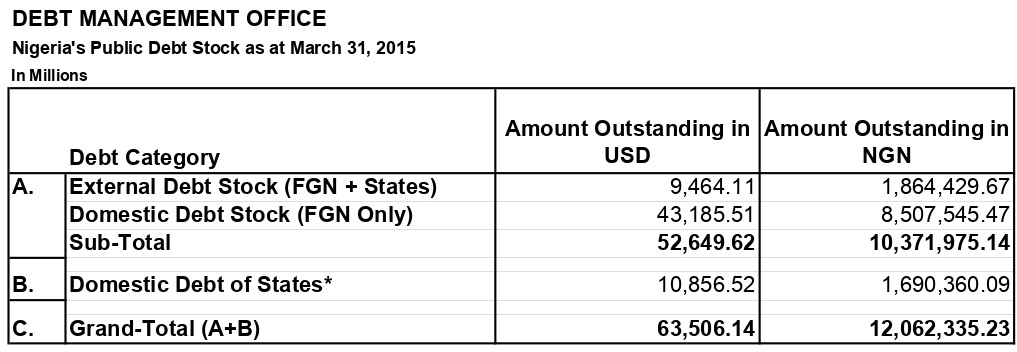

From a modest figure of about N12.06 trillion inherited from its predecessor on May 29, 2015, the projected figure would mean the accumulated debt stock by the administration over eight years spiraled by over 500 percent.

The Director General of the Debt Management Office, Patience Oniha, gave the projection on the debt stock while answering questions during the public presentation of the approved details and highlights of the 2023 FGN Budget by the Minister of Finance, Budget and National Planning, Zainab Ahmed, in Abuja on Wednesday.

Early last month, the debt management agency gave the current public debt stock at about N44.06 trillion as of September 30, 2022.

But the DG said apart from fresh borrowings, the addition of another N22.7 trillion securitized Ways & Means advances by the Central Bank of Nigeria (CBN), which is pending National Assembly approval, would raise the figure to about N77 trillion by June.

However, with some FGN promissory notes valued at about N5 trillion to be issued before next June, the final debt figure might be hovering around N72 trillion.

Ways and Means are advances (or funds) from the CBN to the federal government to enable it to undertake emergency funding of projects and programmes pending the receipt of delayed fiscal deficit in the annual budgetary appropriations.

During the briefing, the DMO DG said her agency was not expecting the total debt figure to be significantly different from the current figure when the December 2022 data would be out, considering that most of the domestic borrowings were completed in September.

However, with the ongoing discussions between the Federal Government and the National Assembly about the Ways and Means by the CBN, she said significant cost saving would be realized if the lawmakers approve the decision to securitize the debt.

“Once the approval from the National Assembly is released, the entire N22.7 trillion Ways & Means is going to be imported into the public debt stock so that the public has the full data on all the debts outstanding.

“It means you will be seeing that figure included in the public debt, which will bring the total figure to about N77 trillion. But if you add the new borrowings and the issuance of promissory notes which are not new borrowings, but arrears, some of which were inherited, give or take, depending on market conditions, will be about N5 trillion. So, we’re looking anywhere at about N72 trillion total debt stock by about June.

“So, we expect that between now and June, some new promissory notes will be issued. So, I think it is safe to say that we will be looking at N72 trillion or thereabout as total debt stock by the time the present administration exits the office,” Oniha explained.

In her presentation, the Minister of Finance, Budget and National Planning, Zainab Ahmed, said the request for the approval of the CBN Ways and Means securitization sent by President Muhammadu Buhari to the National Assembly on December 27 has already passed the first reading on December 29.

The Minister said because the time was too short for the lawmakers to complete the legislation process and approval before proceeding on the Christmas and New year celebrations, further proceedings were postponed till the resumption of formal sittings.

Already she said the lawmakers in the two Chambers of the National Assembly have constituted a special committee to review the relevant documents by the various Ministries, Departments and Agencies (MDAs) relating to the various transactions.

“We’ll be meeting with them and showing them how this has happened. But part of the things that we expect will happen is that once this is approved, it will bring very significant fiscal relief to the federal government.

“Currently, Ways and Means debt is running interest rates at MPR plus three, which today is averaging about 18.5%. That’s a very, very high cost. So, if this is not approved, we’ll end up with interest rates accruing again and adding to the Ways and Means anything from N1.8 trillion to about N2.2 trillion. That’s the consequence the parliament understands and appreciates. So, once that approval is given, we will benefit from a lower interest cost of 9%” she said.

On other details of the 2023 Budget christened “Budget of Fiscal Consolidation and Transition’’ to maintain fiscal viability and ensure smooth transition to the incoming administration, the Minister said key assumptions and macro framework that form the basis for the appropriation include an oil benchmark price of $75 per barrel and oil production capacity of 1.69 million barrels per day; an exchange rate of N435.57 to the dollar, as well as inflation rate of 17.16 percent.

On the overview of the budget, the Minister said the projected fiscal outcome was based on the proposed reform scenario, which assumes that the subsidy on the premium motor spirit (PMS) would remain up to mid-2023 based on the 18-month extension announced in early 2022.

Consequently, she said only N3.36 trillion has been provided for the payment of subsidy on petrol.

The Minister said to make for the realization of the objectives of the Budget, there would be tighter enforcement of the performance management framework for government-owned enterprises (GOEs) to significantly increase operating surplus/dividend remittances to the government coffers during the year.

Total revenue available to fund the Budget, the Minister said, was estimated at about N10.49 trillion, including the gross revenues of 63 GOEs totaling N3.87 trillion, out of which the Federal Government’s share of the oil revenue was projected at N2.29 trillion, non-oil taxes N2.43 trillion, and FGN Independent revenues N2.62 trillion.

Other revenues were projected at about N762 billion, with 22 percent of projected revenues expected as aggregate from oil-related sources, while 78 percent would be earned from non-oil sources.