By Bassey Udo

Effective January 1, 2023, motorists would be paying new rates for motor vehicle insurance, the National insurance Policy Commission (NAICOM) 03740600002095 has announced.

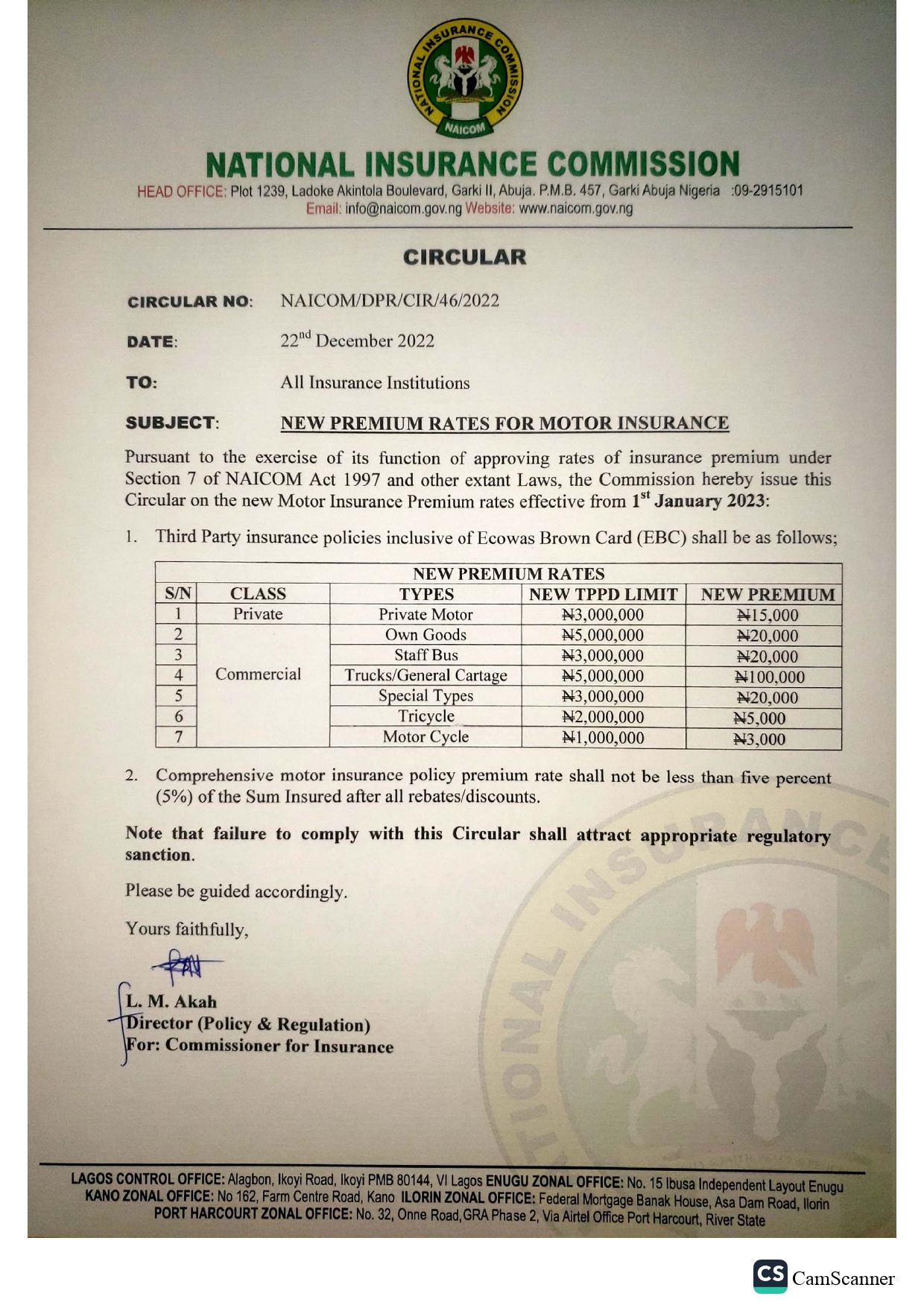

The insurance sector regulator said in a circular No NAICOM/DPR/CIR/46/2022 dated December 22, 2022 signed by the Director of Policy & Regulation, L. M. Akah, to all insurance institutions said the new premium rate for motor insurance would affect both the private and commercial vehicle owners.

Details of the new premium rates in the circular showed that under the class of license, private motor type with third party property damage (TPPD) limit of about N3 million would attract a new premium insurance rate of N15, 000, while private own goods type with TPPD limit of about N5 m would attract a premium rate of N20,000.

TPPD is the limit of claims an insured vehicle can enjoy on the policy.

Private staff bus category with TPPD limit of about N3 m would pay a new premium of N20,000.

In the commercial class, trucks and general cartage with new TPPD limit of N5 m ould be expected to pay a new premium rate of N100,000, while special types of commercial vehicles with new TPPD limit of N3 m would pay a new premium rate of N20,000. Tricycles and motor cycles with new TPPD limits of N2 m and N1 m respectively would pay new premium rates of N5,000 and N3,000 respectively.

Third party insurance policies, the circular said, are inclusive of Economic Community of West African States (ECOWAS) Brown Card (EBC) as per the new rates, types and class stipulated above.

Besides, the circular said comprehensive motor insurance policy premium rate shall not be less than 5 percent of the sum insured after all rebates and discounts.

The Commission said the new premium rates are pursuant to the exercise of its function of approving rates of insurance premium under Section 7 of NAICOM Act 1997 and other extant laws.

The Commission warned that failure to comply with the new rates shall attract appropriate regulatory sanctions.