MEDIATRACNET

The Nigerian National Petroleum Company (NNPC) Limited on Wednesday sealed a $5billion corporate finance deal with the African Export-Import Bank (Afreximbank).

The finance deal is the first by the state-owned national oil company since the coming into existence of the Petroleum Industry Act (PIA) and the incorporation of the company into a limited liability company under the regulation of the Companies and Allied Matters Act (CAMA).

Under the financing deal, Afreximbank agreed to enter into a finance advisory and fundraising role to raise $5billion to “acquire, invest and operate energy producing assets in Nigeria as part of NNPC’s growth strategy following its incorporation as a limited liability company.”

In addition, the bank also agreed to underwrite $1billion as part of forward sales base trade finance transaction.

The commitment from the finance would enable the NNPC to fund some of its major investments in the country’s upstream oil and gas sector.

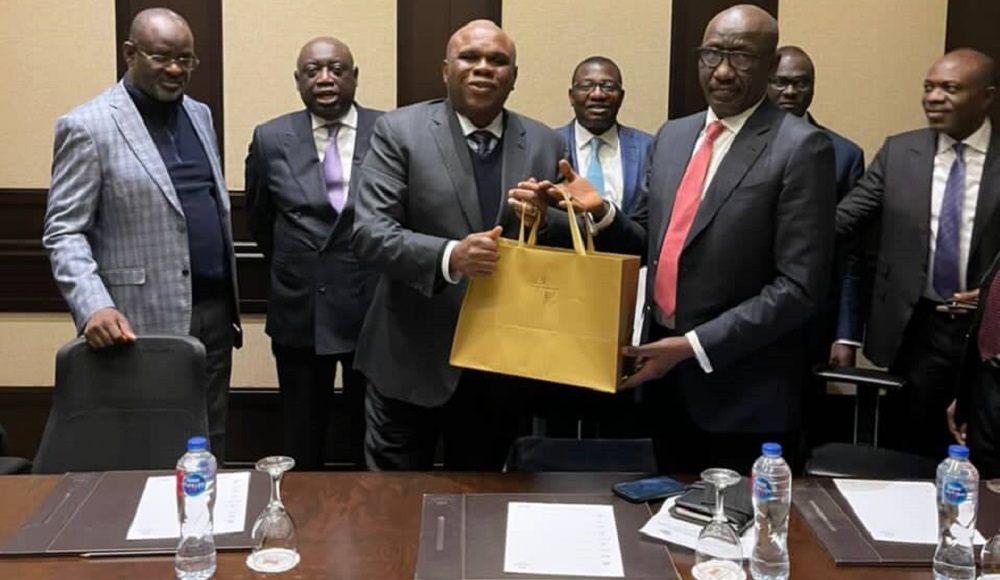

The financing deal was sealed at the end of a meeting between the Chairman, Board of Directors/President of Afreximbank, Benedict Oramah, and the management of NNPC Ltd led by its Group Managing Director/Chief Executive Officer, Mele Kyari, in Cairo, Egypt.

The meeting was attended by the NNPC Chief Financial Officer, Umar Ajiya; NNPC Group Executive Director, Upstream, Adokiye Tombomieye; Group General Manager, National Petroleum Investments Management Services (NAPIMS), Bala Wunti, and Managing Director, NNPC Trading, Lawal Sade.

Following its incorporation into the limited liability company, Kyari had said NNPC’s operational orientation would henceforth change to seeing itself as a business with profit as its ultimate objective.

Consequently, to thrive, he said rather than depend on the government for finance, the NNPC would source for funding from wherever it can find to fund its operations and ensure it functioned profitably to deliver dividends to its shareholders.

Kyari said under the new arrangement, the company would require to raise between $3.5 billion and $5 billion in corporate finance to fund major upstream investments under its funding strategy for selected upstream investments.

To achieve this objective, he said the NNPC planned to acquire pre-emptive rights in select Joint Venture operations in the industry as well as take over the ownership of some non-investing partnerships.

The NNPC’s strategy, Kyari said, also included investing in strategic assets to address integrity, bottlenecking, and growth issues in the oil industry, such as rigless activities and oil drilling campaigns.

He said the company preferred to find lenders who can provide this funding in a ratio based on each lender’s capacity to help finance part of the NNPC’s key investments, including acquisition of equity interests in quality upstream oil and gas producing assets.

The acquisition of these assets, Kyari said, was an integral part of the NNPC’s corporate strategy to rebalance its oil and gas portfolio, by divesting from some toxic assets, to enable it to acquire choice strategic assets that would help support its long-term strategic objectives.

Under the agreement signed by both parties, the repayment of the finance would be through a Forward Sale Arrangement, which would allow the funds provided to constitute the payment purchase of 90 to 120,000 barrels per day of crude oil to be delivered to the lender over a period.

The repayment of the fund is projected to be made within a four to eight years period, with an objective to ensure major fiscal obligations and operating expenses are discharged appropriately

The meeting between the NNPC and Afreximbank team agreed to intensify efforts at deepening investments in Nigeria’s oil and gas sector.

Also, the NNPC and the Afreximbank agreed to, among other things, deepen the business collaboration between the two institutions.