By Bassey Udo

For the Nigerian capital market to be competitive and relevant, it must adapt to

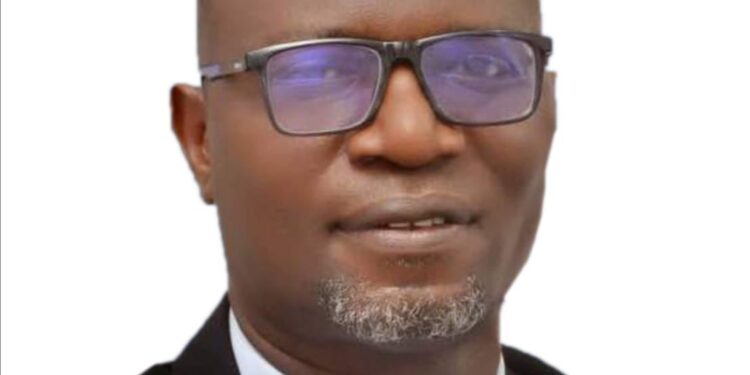

global shift towards sustainable finance, The Director General of the Securities and Exchange Commission (SEC), Dr. Emomotimi Agama, has said.

Speaking at the 2025 Annual Conference of the Chartered Institute of Stockbrokers in Abuja, Dr. Agama said sustainable finance was redefining the trends in investment decisions, corporate governance and risk management.

The DG described sustainability as a global imperative that goes beyond technology and ethics, noting that environmental, social and governance (ESG) considerations were now shaping responsible investment and capital allocation across the world.

In line with this, he said the Commission has taken bold steps to align its market with global sustainability standards.

Through the adoption of the International Sustainability Standards Board (ISSB) framework, the Green Bond Programme, and SEC’s collaboration with development partners, he said the groundwork for a financial system was being laid to support the country’s transition to a low-carbon, inclusive economy.

He underlined the critical role stockbrokers and other market operators have to play to promote sustainable investment products, advising issuers on ESG disclosures and guiding investors towards responsible assets.

The SEC and the Chartered Institute of Stockbrokers (CIS), he noted, share a common vision of building a capital market that mobilises savings for productive investment, creates jobs and drives economic diversification.

The SEC’s partnership with the Institute in areas such as professional certification, investor education, financial literacy, and policy advocacy, he pointed out, has continued to yield positive results, adding that both still have to do more.

“The task ahead is to ensure that the capital market becomes central to Nigeria’s economic transformation agenda — a market that finances infrastructure, empowers MSMEs, supports green and digital enterprises, and contributes meaningfully to the realization of a trillion-dollar economy,” he said.

He commended the resilience and professionalism of market operators despite challenging conditions, saying it reflects the enduring strength of the Nigerian capital market and its potential to transform the nation’s economic landscape.

“With the world changing fast, the Nigerian capital market must not only keep pace, but lead by example,” he added. “Let us therefore recommit to innovation that empowers, ethics that endure, and sustainability that delivers long-term prosperity for all.”