Africa will need to focus more on removing barriers to provide better access to trade finance to bridge the existing gap in trade currently estimated at an average of $100 billion and $120billion.

The Group Chief Economist and Managing Director, Research at Afreximbank, Dr Yemi Kale, said one of the ways to remove the barriers was the ongoing effort by Afreximbank to support effort harmonise the payment systems and legal frameworks across the continent.

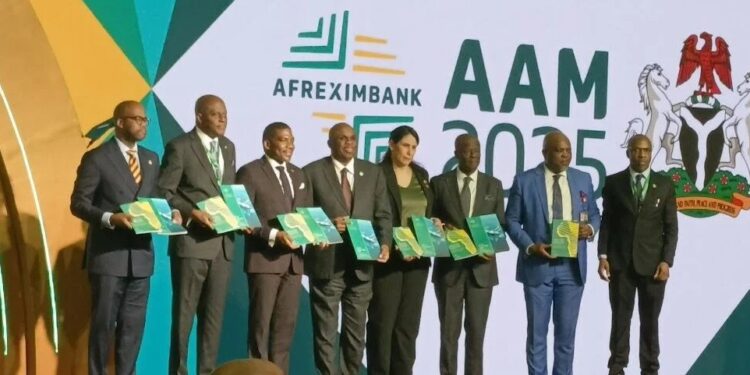

Kale stated this while fielding questions after the unveiling of Afreximbank flagship African Trade Report 2025, on the theme “African Trade in a Changing Global Financial Architecture” during the Bank’s 32nd Annual Meetings in Abuja Wednesday.

He said the decision by the Bank to spearhead the mobilisation of all Africa Central Banks to subscribe to the Pan-African Payment and Settlement System (PAPSS) was to help to reduce reliance on foreign currencies in business transactions to make cross-border trade more efficient.

The report reviewed the performance of Africa’s trade amid the challenges in the global environment characterised by rising geopolitical tensions, new trade barriers, and financial uncertainties.

Also, the report analysed how Africa could leverage on the opportunities that emerge from these challenges to enhance its resilience and navigate the evolving landscape.

“Despite global headwinds, Africa’s trade rebounded strongly in 2024, with trade between African countries, growing by 12.4% to reach $220.3 billion, from a contraction of 5.9% in 2023,” Dr. Kale said.

The growth, Kale said, shows the tangible benefits of AfCFTA implementation, even as the continent contends with a number of challenges, including rising inflation, sovereign debt risks, and a persistent trade finance gap.

Other highlights of the report showed that Africa’s total merchandise trade recovered, surging by 13.9% in 2024, to $1.5 trillion, following a 5.4% contraction in 2023.

However, that Africa still accounts for only 3.3% of global exports, the report said, poses a clear signal for the continent to do more, by moving away from commodity exports to accelerate its industrialisation process to enhance its integration into global value chains and boost intra-African trade.

Despite the growth in global economy declining to 3.3% in 2024 and the expectation for it to dip further in 2025, the report said Africa’s economy, which grew by 3.2%, has held steady, helped by strong commodity prices and better public finances, although growth remains uneven across the continent.

President and Chairman of the Board of Directors of Afreximbank, Professor Benedict Oramah, said this year’s report provides a compelling roadmap for Africa to reposition itself in a volatile global economy.

“From strengthening trade finance systems to accelerating the AfCFTA, the message is clear: Africa must turn global fragmentation into an opportunity for industrialisation, digital progress, and greater control over its financial systems,” Oramah said.

Afreximbank’s African Trade Report 2025 emphasises the importance of advancing the AfCFTA, which is expected to provide the foundation for trade resilience across the region.

It also highlighted the expanding use of the Pan-African Payment and Settlement System (PAPSS), and the need to harmonise the payment systems and legal frameworks across Africa to help close the gaps, foster regional trade and enhance growth, particularly for small and medium-sized enterprises (SMEs).

The report proffered practical guidance on making trade rules and regulations more consistent across countries, unlocking investment from African institutions like pension funds and sovereign funds, and using Africa’s new seat in the G20 to push for overdue global reforms.

This includes ensuring a fairer share of global financial resources, such as Special Drawing Rights, an international reserve currency created by the International Monetary Fund (IMF) and increasing access to climate finance, while calling for changes in credit ratings to better reflect the strength and potential of African economies.

The report highlights the growing significance of the Alliance of African Multilateral Financial Institutions (AAMFI), as it is increasing funding for development and helping to rebuild a financial ecosystem that works better for Africans.

In 2024, the report revealed that Afreximbank alone disbursed more than $17.5 billion in trade finance, with plans to increase that amount to $40 billion by 2026.

As Africa faces a rapidly changing global environment, the report proffered practical plans for building a stronger, fairer, and more resilient African economy, driven from within the continent where the central banks in 16 African countries have already adopted PAPSS are now connected together in their financial systems.

Some of the countries that have so far integrated into the PAPSS system include Nigeria, Ghana, Liberia, The Gambia, Guinea, Sierra Leone, Kenya, Zimbabwe, Zambia, and Djibouti.

The integration in the PAPSS system has been identified as a significant milestone in Africa’s journey toward payment system integration and financial independence, as it has helped to significantly cut down on reliance on the dollar, which has for long constituted a major barrier to businesses, especially SMEs, to fully participate in both domestic and international trades.

The development, he disclosed, has sliced transaction costs by SMEs by as much as 50 percent, while ensuring cost efficiency in support of Africa’s quest to deepen regional trade under the AfCFTA.

Sustaining and expanding the integration of the PAPSS, Kale pointed out, was crucial for bridging the gap, unlocking the value chains and enabling seamless trade among SMEs in Africa.

Such efforts, he said, are crucial for unlocking value chains and enabling seamless trade, particularly for small and medium-sized enterprises (SMEs) facing the challenges such as bureaucracy, licensing barriers, and regulatory inconsistencies in engaging seamless commerce across borders.

Without access to adequate funding, he said many of the businesses are constrained in their effort to either take advantage of the emerging trade opportunities or scale up their operations to meet growing demand.

Other constraints to effective trade include poor infrastructure and high operational costs, which contributes to the cost of doing business.

To bridge the existing gap and promote inclusive growth across the continent, Kale underlined the need for sustained investment in infrastructural development, regulatory alignment, development of financial instruments tailored to suit the peculiar needs of SMEs, stronger regional banking support and the development of tailored financial instruments to enhance the capacity of the businesses to participate in the growing intra-African trade currently valued at about $220 billion, growing from 5.9 percent in 2023 to 12.4 percent.