The 36 State governments in the Federation and the Federal Capital Territory (FCT) must buckle up, develop and implement strategies to boost their internally generating revenue (IGR) to enable them avoid over-dependence on statutory allocations from the Federation Account, the Nigeria Extractive Industries Transparency Initiative (NEITI) has said.

NEITI observed in its 2020-2021 Fiscal Allocation and Statutory Disbursement (FASD) Audit Report published on Thursday in Abuja that the high deductions by the Federal Government from the statutory allocations of the States have left them vulnerable to dislocations in their developmental plans if they do not have a solid alternative source of revenue.

Impact of statutory deductions

The report highlighted the impact of some of the statutory deductions, like the Federal Government Irrevocable Standing Payment Order (ISPO), on the revenue of States, saying that without an urgent review of States’ IGR strategies, they would be left with no sufficient financial elbow room to implement their policies and programmes to better the lives of the people in their domains.

ISPO is a mandatory instruction to the authorities of the Federation Account to deduct from source on a monthly basis all payments a State Government is obligated to make in respect financial transactions by a previous administration in respect of the purchase of FGN bonds or local or foreign loans guaranteed by the Federal Government.

Highlights of the reports showed that all the States of the Federation were saddled with various degrees of obligations they had to fulfill through the repayment of huge amounts by way of monthly statutory deductions from their Federal allocations pursuant to those orders.

Other sources of revenue

Apart from the statutory allocations from the Federation Account, findings from the report revealed that the only other sources of revenue for the various State governments were their IGRs, grants, donations, internal and external loans, etc.

Those obligations for which deductions were made from the States’ statutory allocations from the Federation Account during the period under review, the report showed, included external debts/Foreign Loan repayments, contractual obligations, Irrevocable Standing Payment Order (ISPO), salary bailouts, Excess Crude Account loan facility, Central Bank of Nigeria (CBN) budget support facility, overpayment of 13% derivation, CBN Micro, Small and Medium Enterprises (MSME) Development Fund, FGN Bonds and Accelerated Agricultural Development Scheme (AADS).

The report said the States would have been in a better place after such deductions from their statutory allocations if they developed and implemented strategies to boost their IGR through improved collection of taxes, rents, earnings from services, grants, and subventions, dividends, and interest accruals from Investments and other incomes from law enforcement activities, including fees, fines, licenses, sales of fertilizers, etc.

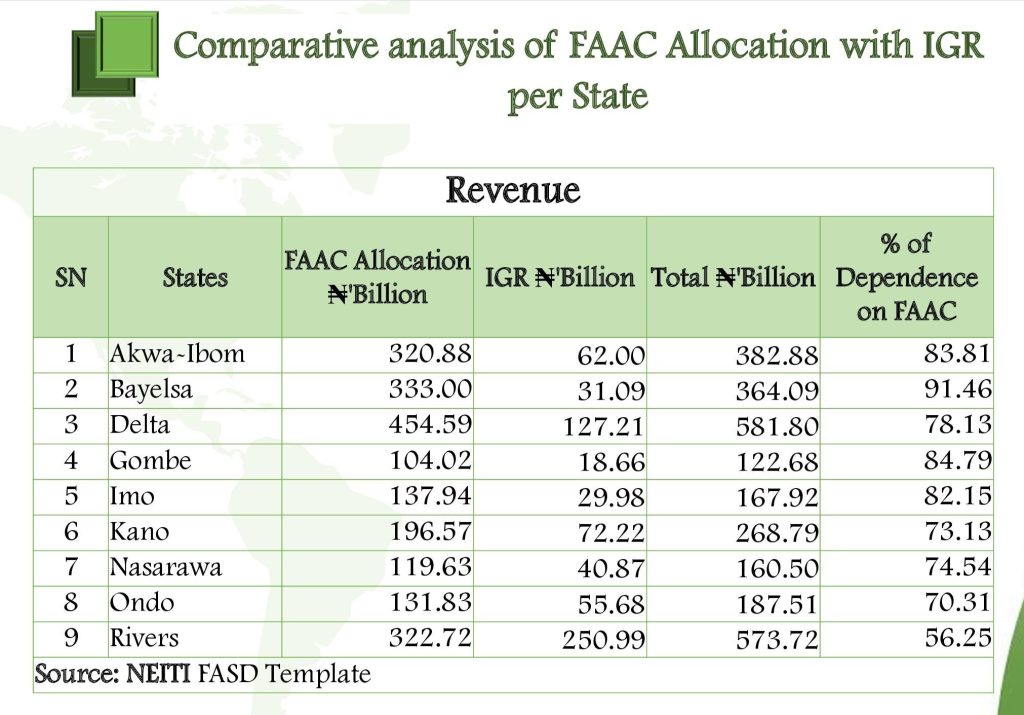

Nine States’ dependence on FAAC

An analysis of the performance of the nine representative States selected from across the six geopolitical zones in the country, namely, Akwa Ibom, Bayelsa, Delta, Gombe, Imo, Nasarawa, Ondo, Rivers and Kano, showed that most of the States, including those in the oil-producing areas that receive additional revenues from the 13 percent derivation payment, were highly vulnerable to unforeseen shocks, as data confirmed they depended almost entirely on revenue allocations from the Federation Account during the period under review.

A comparative analysis of the nine selected States revealed that statutory allocations from the Federation Account, which amounted to about N2.12trn, or 62% of the total revenue receipts for the period, grew by 15.99% in 2021, from 2020.

Further details from the analysis showed that Delta State, which collected the highest statutory allocation of N454.59 bn between 2020 and 2021, depended on the Federation Account allocation by over 78.13 percent, as it realized only N127.21 bn as IGR for the period, same as Bayelsa State, which was able to generate a paltry N31.09bn, against N333bn it collected as statutory allocation for the period.

Similarly, Akwa Ibom State, which collected over N320.88bn from the Federation Account for the period, generated only N62bn as IGR, depending on the Federation Account revenue by 83.81 percent, just like

Rivers State, which depended on the Federation Account allocation by 56.25 percent as a result of collecting a total of N322.72bn for the period, against an IGR of N250.99bn.

Despite collecting over N196.57bn for the period, the report said Kano State was dependent on the statutory allocation from the Federation Account with only N72.22bn contribution to its purse as IGR, the same thing as Imo State, which depended on statutory allocation from the Federation Account by 82.15 percent having collected N137.94bn from the Federation Account, against its IGR of N29.98bn only.

The story was not different with Ondo State, which depended on statutory allocation from the Federation Account by 70.31 percent, having collected N131.83bn over the period and generating IGR of N55.68bn; Nasarawa State depended on the Federation Account by 74.54 percent with N119.63bn statutory allocation collection against N40.87bn IGR, while depended on Federation Account by 84.79 percent, having collected a total of N104.02bn as statutory allocation against an IGR of only N18.66bn for the period.

Minimizing dependence on FAAC

To ensure self-sufficiency and minimize the level of dependence on Federal allocations, the report recommended that State Governments should explore alternative sources of revenue, by creatively developing strategies and leveraging existing laws, and regulations to improve non-federal revenue/receipts.

Details from the report showed that Delta, Akwa Ibom, Rivers, and Bayelsa States received 67.47% of the total Federal Allocation during the period, while Gombe, Nasarawa, and Ondo States got the least allocations.

On IGR, the report said the States realized a total of about N695.22bn, representing 20.37% of the total States’ receipts for the period, with Rivers, Delta, Kano and Akwa Ibom accounting for 74.64%.

With total IGR rising by 27% from N305.7bn in 2020 to N389.48bn in 2021, the report said Imo State had the highest increase (115.73%) of IGR during the period, while Nasarawa State had the least increase (4.04%).

Similarly, in 2021, the report said Bayelsa, Delta and Kano States’ IGR grew significantly by 48.80%, 38.53%, and 26.97% respectively, as a result of the IGR strategies adopted by the respective State Governments to improve their revenue.

In terms of receipts from loans, the report revealed that the total by the State Governments for the period was N747.22bn, with Rivers, Kano, Delta and Imo States accounting for 81.69% of the total, which increased by 258.68% in 2021, an indication of over-dependence on borrowing by the States.

While loan receipts increased in other States, the report said Bayelsa and Nasarawa States did not receive loans in 2020, while the loan receipts by Rivers, Akwa Ibom, Gombe and Imo States, rose the highest, accounting for 935.27%, 680.91%, 435.39% and 390.46% respectively.

The report observed that a significant increase in loan receipts for most of the States during the period was an indication that the State Governments were yet to build a corresponding revenue expansion base to augment shortfalls in revenue, which may impact negatively on their abilities to deliver services to their citizens.

On grants, the report showed that total grant receipts by the States for the period was about N146.25bn, with Kano, Akwa Ibom, Delta, Gombe and Nasarawa, accounted for 23.20%, 17.26%, 16.58%, 13.41% and 11.88% respectively, while Imo, Bayelsa, Rivers and Ondo States received 17.67%.

With Imo, Bayelsa and Rivers receiving the least grants, accounting for 3.86%, 3.44% and 0.65% respectively during the period, the report said this called for efforts by these State Governments to attract aids and grants with a view to supporting development in their states.

Specifically, the report said the State Governments should develop a robust grants sourcing and management strategy to boost receipts from grants and aids.