The 2020-2021 Fiscal Allocation and Statutory Disbursement (FASD) Audit Report published recently by the Nigerian Extractive Industries Transparency Initiative (NEITI) has revealed that all the 36 States of the Federation performed poorly, in terms of their internally generated revenue (IGR) against statutory allocations received from the Federation Account in the two years.

In the report presented a fortnight ago in Abuja, NEITI said total remittances to the Federation Account for the period by four of the five revenue-generating agencies, namely Federal Inland Revenue Service (FIRS), defunct Nigerian National Petroleum Corporation (NNPC), defunct Department of Petroleum Resources (DPR), and the Ministry of Mines and Steel Development (MMSD), was ₦14.38 tr.

Performance indicators

An analysis of the performance of some of the oil-producing States among the nine representative States in the report selected from across the six geopolitical zones showed that despite benefiting from the additional allocation of 13 percent derivation revenue, they were still unable to live above dependence on Federal allocation and debts.

The nine States selected for the report included Akwa Ibom, Bayelsa, Delta, Gombe, Imo, Nasarawa, Ondo, Rivers and Kano.

A review of the report showed that all the oil-producing areas selected among the nine representative States in the report, namely Akwa Ibom, Bayelsa, Delta, Imo, Ondo and Rivers, were as vulnerable to shocks as all the other States of the Federation, as data confirmed all of them depended almost entirely on revenue allocations from the Federation Account during the period under review.

None of the States was able to record any significant progress toward meeting any of the 17 Sustainable Development Goals (SDGs) and 169 targets, which include ending poverty, improving health and education, creating more sustainable cities, and promoting environmental protection by 2030.

Out of the total remittances to the Federation Account, the report said the three tiers of government were allocated a total of ₦5.42 tr., shared into Federal (₦2.80 tr.), 36 States (₦1.45 tr.) and 774 Local Councils (₦1.17 tr.).

Also, the report showed that a total of ₦859.66 bn. was shared as 13% derivation oil revenue among the nine oil producing States, namely Abia, Akwa Ibom, Anambra, Bayelsa, Delta, Edo, Imo, Ondo, and Rivers.

An additional revenue of N972.71bn. was equally shared among the three tiers of government as Exchange Gain, Domestic Excess Naira, Excess Oil Revenue, Non-Oil Excess Revenue, Solid Mineral, FOREX Equalization, FGN Intervention, and Excess Bank Charges.

The total statutory allocation of N4.58tr., which included gross statutory allocation (N2.55 tr.) and Value Added Tax (VAT) N2.03tr., showed that three of the oil producing States, namely Delta, Rivers, and Akwa Ibom, along with Lagos, collected the highest allocation for the period under review, while Gombe, Ogun, Ekiti, Plateau, Cross River and Osun took the lowest allocations.

The statutory allocations to the States followed deductions from the States’ allocations for various obligations they were liable to meet in respect of external debts servicing and repayment for foreign loans; settlement of obligations in respect of contracts the Federal Government acted as guarantor; Irrevocable Standing Payment Order (ISPO), refund for credit facility due to salary bailout, defrayal of Excess Crude Account loans, repayment of CBN budget support facility, refund for over-payment of 13% derivation, repayment for CBN MSME development facility, payment for FGN bonds, and defrayal for financial obligations in CBN Accelerated Agricultural Development Scheme.

To make up for the deductions from their statutory allocations, the States turned to their internally generated revenues (IGRs) from taxes collected by their State Board of Inland Revenue Service; rents from lands and state buildings; earnings from the provision of paid services; receipts of grants, donations and subventions from domestic and international agencies; dividends and interests from government investments, and miscellaneous incomes from fees, fines, licenses, sales of fertilizers, etc.

However, a comparative analysis of the situation in the nine selected States in the report showed that the statutory deductions from the States’ allocations from the Federation Account and the inadequate IGR situation compelled the States to resort to borrowing to provide alternative funding for projects and programmes to meet their obligations to the people in their domains.

Comparative analysis

Specifically, a review of the situation among the five oil producing States among the nine selected for the report revealed that despite the additional income from the 13 percent oil derivation receipts, which offered some cushion, they were hardly able to survive without dependence on allocations from the Federation Account, as their IGR profiles usually proved insufficient to make the difference.

Akwa Ibom

For Akwa Ibom, the report showed that Federal allocation to the State during the period decreased marginally by N2.02bn (1.25%), from N161.45bn in 2020 to N159.43bn in 2021, as a result of the absence of interventions enjoyed in 2020 to cushion the effect of COVID-19 pandemic.

Overall, the percentage contribution of Federal allocation to total revenue receipts (N218.92bn) fell significantly from 81.07% in 2020 to 42.31% in 2021, the State’s IGR and other incomes sourced from direct taxes, fees and rent on land, grew significantly by N129.60bn (290.18%) in 2021, with its contribution to total receipts increasing from 21.20 % in 2020 to 47.15%.

With total statutory deduction from a fairly stable Federal allocation to the State at N27.58bn in 2021 and a significant growth in its IGR by 476%, the report said the State’s major statutory deductions were for FGN bonds and monthly payments for past financial transactions that resulted in Irrevocable Standing Payment Order (ISPO) issued to FGN.

With the State’s total revenue for 2020 and 2021 at about N218.92 bn., or 37.72% of the total revenue, it received additional revenue from the 13 percent derivation receipt of about N182.23 bn., or 31.40 percent; IGR was N62.01bn, or 10.69; other income N138.12bn. and local grants N18.80bn., or 3.24 percent.

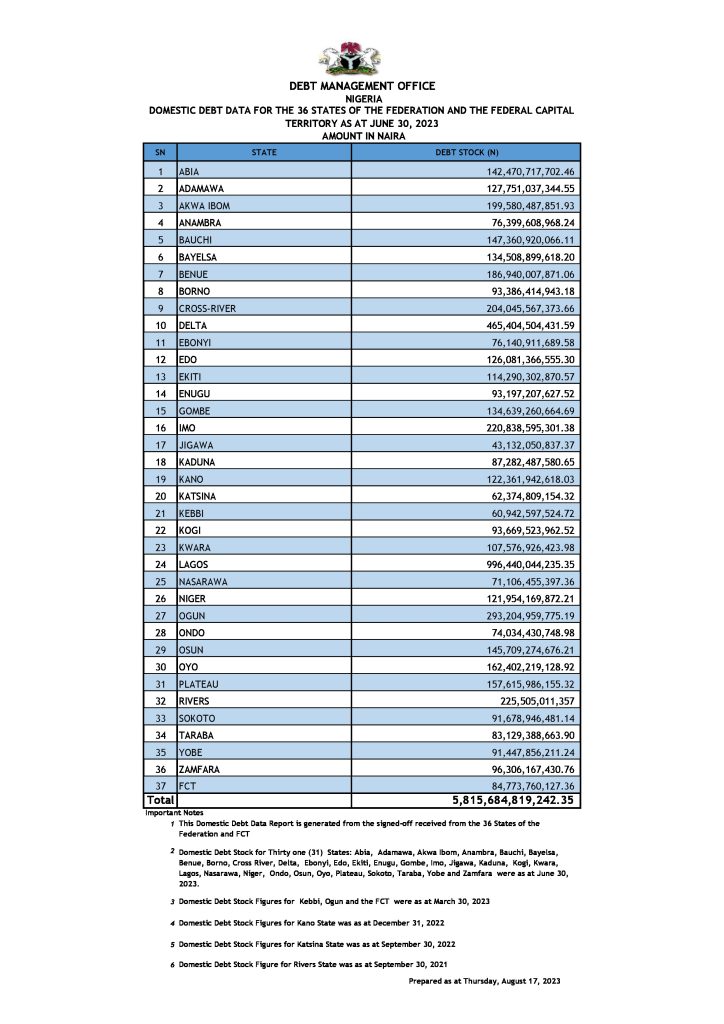

Data from the Debt Management Office (DMO) showed the State’s debt profile of N199.58bn out of the overall debt portfolio of N5.82tr. for the 36 States and the Federal Capital Territory (FCT) as at June 30, 2023, ranked among some of the highest.

Consequently, the report recommended that the State should continue its drive towards increased IGR generation to become less dependent on federal allocation as well as improved self-sufficiency, while loans should be judiciously utilized on viable capital investments to foster economic activities to unlock opportunities in private sector investments.

Bayelsa

For Bayelsa State, the report revealed that statutory allocation from the Federation Account accounted for 68.17 percent of its total revenue receipts in 2020, and 80.69% in 2021, with other sources of revenue being State generation, grants, and loans.

Findings from the report showed a 30.18 percent decrease in the State’s net IGR in 2020 and 8.65 percent in 2021, with local loans in 2021 at ₦20.7bn.

Total statutory deduction from federal allocation to the state for the period, the report said, was N41.52bn, with FGN bond amounting to N17.79bn (42.84%), Refund (₦11.28billion), or 27.16%, and other statutory deduction in respect of monthly payment obligations for past financial transactions that resulted in Irrevocable Standing Payment Order (ISPO) issued to FGN 30.00%.

With receipts of N435.70bn, including 13 percent derivation revenue of N168.39bn as one of the nine major oil-producing States, other incomes included COVID-19 donations (N7.37 bn), or 1.69 percent; bailout refunds from LGAs N82mn, or 0.02 percent; recovery of vehicle loan N1million, and FGN reimbursement N38.40bn, or 8.81percent; internal loans N20.73bn, or 4.76percent, grants N5.03bn, or 1.15percent and additional payment of N58.28bn, or 13.38 percent as 13% derivation.

The report showed the State relied 75 percent on revenue receipts from the Federation Account, despite that its IGR and investment income improved in 2020, with revenues from loans and grants.

The DMO said the State was still saddled with a debt profile of N134.51bn as of June 30, 2023.

The report recommended that the State should creatively develop strategies and tactics within the ambits of the extant laws and regulations to improve the IGR potential, while matters relating to IGR should be given adequate attention by seeking the assistance of relevant professionals to drive the innovation required to improve IGR.

Also, the report emphasized the need for the State to ensure the purposes for which loans are taken are carefully reviewed to ensure that the facilities are not used for projects not self-financing either directly or indirectly.

Delta

For Delta State, the report showed that Federal Allocation to the state increased by N46.90 bn (23.00%), from N203.85bn in 2020 to N250.74bn in 2021 as a result of a significant increase in 13 percent Derivation (632.80 percent), and VAT and Excess Crude (FOREX Equalization).

Overall, the report said the percentage contribution of Federal Allocation to the State’s total revenue receipts fell from 72.49 percent in 2020 to 66.97percent in 2021, with significant increase in IGR by N20.55bn (38.53 percent) in 2021, a total of N127.21bn, or 19.40 percent as a result of a rise in tax and non-tax revenue generated by the state.

Other incomes, the report said, came from extraordinary or exceptional sources, like the Ecological Fund of N830.81mn, or 0.13 percent; investment income of N254.81mn, or 0.04 percent; N1.02bn, or 0.16 percent, and internal and external loans totaling ₦58.80bn obtained from local sources, and grants received (₦12.90bn).

As one of the oil-producing States, its share of the 13 percent derivation was N49.89bn, or 7.61 percent of its total revenue, with allocation from the Federation Account accounting for 69.34% percent of the total revenue, while IGR accounted for 19.40 percent, and other income from loans only 2.29 percent.

Total statutory deduction from Federal Allocation to the state, the report said, was about N29.99bn, with major deductions for Contractual Obligation N29.17bn (97.23 percent), while other deductions of N831.32mn (2.77 percent) for monthly payments for past financial transactions that resulted in Irrevocable Standing Payment Order (ISPO) issued to FGN.

Findings from the report showed that the State relied heavily on allocations from the Federation Account, despite improvement in its IGR; greater increase in borrowing between 2020 and 2021, and increased loans and grants from local and foreign sources by 288 percent.

The DMO puts the state’s debt stock as of June 30, 2023, at N465.41 bn.

Consequently, the report called on the State government to adopt measures to sustain the innovations that would lead to increased IGR to guarantee self-sufficiency, while striving to reduce borrowings and ensure borrowed funds are invested in ventures that would ensure ease of repayment.

Revenue from Federation Account, the report said, remained the main source of revenue for Gombe State (52.16 percent) of the total State revenue, with IGR relatively low.

Although IGR increased by 16.05 percent in 2021, the report said loans and grants contributed bigger shares to the total State revenue than IGR, with local loans increasing significantly by over 500 percent.

Gombe is not one of the States that received the 13 percent derivation. The report showed the State’s IGR for the period was only N18.66bn, or 9.36 percent of the total revenue, with other incomes, including BTL receipts of N28.32bn; local and international grants (N19.62bn), or 9.84 percent, and local and international loans (N28.81bn), or 14.44 percent.

Due to its obligation to make monthly payments, because of past financial transactions that resulted in an Irrevocable Standing Payment Order (ISPO) issued to FGN, the report showed that the total statutory deduction from Federal Allocation to the State was N67.26 bn, with FGN bond of N4.34bn (6.45 percent), while domestic loan repayment was N34.69 billion (51.57 percent).

The report showed the State is highly dependent on Federal Allocation, an indication that it was not self-sustaining and may not be able to withstand the challenges that may arise from fluctuations in crude oil prices.

Although the report said the State made progress by improving its IGR by 16 percent in 2021, its revenue was augmented with about ₦28.8bn from loans during the period under review.

The DMO sub-national debt statistics showed that the State has a debt profile of about N134.64bn as of June 30, 2023.

The report, therefore recommended that the State should continue its revenue drive to meet its expenditure budget without relying on Federal Allocation while continuing to innovate to improve its IGR potential to guarantee future self-sufficiency.

The report stressed the need for the State to review its current IGR strategies to achieve sustainable revenue growth, while ensuring the purpose for which loans were taken were reviewed to ensure the facilities were not used for projects that were not self-financing either directly or indirectly.

Imo

For Imo State, the report showed that Federal Allocation to the State accounted for 57.08 percent of the total revenue inflows, while IGR accounted for 12.40 percent, with other income and loans representing 8.81 percent and 21.70 percent of the total inflows respectively.

Further details showed that Federal Allocation increased by ₦6.28bn (9.54 percent), from ₦66.83bn in 2020 to ₦72.11bn in 2021, due to the increase in economic activities post-pandemic (COVID-19) lock-down.

Despite the increase in Federal Allocation to the State in 2021, the report said the percentage contribution dropped significantly from 69.50 percent in 2020 to 49.01% in 2021 due to a significant rise in IGR and loans.

With an obligation to make monthly payments for past financial transactions that resulted in an Irrevocable Standing Payment Order (ISPO) issued to the FGN, the report said the total statutory deduction from Federal Allocation to the State was ₦20.86bn, major for restructuring to commercial bank loan amounting to ₦11.74bn (56.29 percent).

Findings from the report showed that while the State maintained an upward trend in its IGR, its contribution to its total revenue was only a meager fraction given the economic potentials of the State, with a significant increase of 390.46 percent in loans collected in 2021, from N8.88bn in 2020 to N43.57bn in 2021.

The State received the 13 percent derivation of N18.72bn, or 7.75 percent of its total revenue, with IGR figure for the period at N29.98bn, or 12.40 percent, in addition to other incomes, including grants, refund of FGN payee, refund of excess tax and refund of DNRF by CBN totaling N21.299bn. External Loans and funds from other sources summed up to N52.45bn, or 21.70 percent.

DMO’s debt data showed that as of June 30, 2023, the State’s debt stock stood at about N220.84bn.

The report recommended that the State should adopt critical measures to ensure improvement in its IGR revenue, while engaging the services of revenue generation experts to support them in developing and implementing strategies to drive revenue.

Kano

In Kano State, the report revealed that with total revenues at about N520.37bn for the period, allocation from the Federation Account to the State accounted for 37.78 percent, while IGR accounted for 13.88 percent, and other incomes and loans represented 6.86 percent and 41.48 percent respectively.

Details showed that Federal Allocation increased by N24.13bn (27.99 percent), from N86.22bn in 2020 to N110.35bn in 2021 due to the rise in economic activities post-pandemic (COVID-19) lock-down.

Overall, the report said while the percentage contribution of Federal Allocation to total revenue receipts of the State decreased from 39.30 percent in 2020 to 36.67 percent in 2021, IGR increased by N8.85bn (26.97 percent) in 2021.

Despite the increase in the State’s IGR, the report said its percentage contribution to total revenue in 2021 dropped due to the significant increase in Federal Allocation and loans in 2021, with other income representing extraordinary or exceptional income from sources outside the usual or ordinary activities of the State Government.

With the State’s obligation to make monthly payments for past financial transactions that resulted in an Irrevocable Standing Payment Order (ISPO) issued to the FGN, the report said total statutory deduction from Federal Allocation to the State increased by 236 percent between 2020 and 2021, to N17.78bn, with Contractual Obligations (ISPO) amounting to N7.36bn (41.39 percent).

Findings from the report showed a downward movement of the State’s IGR, from N56.72bn in 2020 to N51.21bn in 2021, representing 20.74 percent of total receipts for the period under review.

The contribution of IGR to the overall revenue, the report said, was considered marginal, given the economic potentials of the State, while loans continued to be a major source of revenue, with a significant increase of 82.29 percent over the period. leading to an increase in the cost of loan servicing.

The State’s IGR for the period stood at about N72.22bn, or 13.88 percent of the total revenue, with other incomes made up of investment income, local and foreign grants, and aid totaling N35.71bn, or 6.86 percent.

Debt data from the DMO showed the State has a debt profile of about N122.36bn as of June 30, 2023.

The report recommended that the State should ensure that all its revenue-generating agencies should develop and implement strategies towards improved revenue generation to ensure lesser dependence on Federal Allocation, while the State Internal Revenue Service (IRS) should expand its tax net and ensure maximum tax collection.

Also, the report said the State should ensure that loans are judiciously utilized on viable capital investments to foster economic activities to unlock the opportunities in private sector investments.

Nasarawa

For Nasarawa State, with total revenue for the years at ₦177.88bn, the report said allocation from the Federation Account represented the largest revenue head for the period, despite a 12 percent reduction from ₦63.80bn in 2020 to ₦55.84bn in 2021.

The report said the State’s IGR recorded a slight increase of 4 percent (₦809mn), with total grants amounting to ₦17.40bn in 2020, and a 24 percent reduction in Federal Allocation in 2021.

The ratio of Federal Allocation to total State revenue increased from 61 percent in 2020 to 71 percent in 2021, an indication of a low IGR by the state.

The report showed that the total statutory deduction from Federal Allocation to the State was N7.70bn, with the major deductions for State bond, Budget support, and FGN bond of ₦2.99bn (38.86 percent), ₦1.39bn (18.01 percent) and ₦1.12 bn (14.52%) respectively.

The deductions were as a result of loans that were guaranteed by the FGN, although the total figures decreased from N3.9bn in 2020 to N3.8bn in 2021.

Other deductions for obligations to make monthly payments for past financial transactions that resulted in an Irrevocable Standing Payment Order (ISPO) issued to FGN amounted to N2.20bn (28.61 percent).

Findings from the reports showed that the State remained highly dependent on Federal Allocation which makes up 67.3 percent of the total revenue generated by the State for the period, an indication that the State was not self-sustaining and may not be able to stand the challenges that may arise to cause fluctuations in federal allocation.

Nasarawa did not receive the 13 percent derivation. But IGR was N40.87bn, or 22.98 percent, with other incomes consisting of grants of about N17.38bn, or 9.77 percent of the total revenue.

The DMO data revealed that the State has a debt profile of N71.12bn as of June 30, 2023.

The report recommended that the State should creatively develop strategies for improving and sustaining its revenue generation capacity to ensure economic growth while improving the monitoring process of loan utilization to ensure such funds were committed to the purposes for which they were taken in the first instance.

Ondo

For Ondo, the report said with total revenue for the period at ₦254.69bn, IGR receipts for 2020 accounted for 52.95 percent, including grants, donations and Federal Government COVID-19 relief to the State to cushion the effect of the pandemic.

Out of the total revenue, the report said Federal Allocation to the State accounted for 51.76 percent, while IGR accounted for 21.86 percent and other income and loans 8.15 percent and 18.22 percent respectively.

Although Federal allocations increased marginally by ₦4.80bn (7.6 percent), from ₦63.50bn in 2020 to ₦68.33bn in 2021 due to an increase in Value Added Tax (VAT) and non-oil revenue, by ₦6.49bn (43.60 percent) and ₦1.16bn (186.8 percent) respectively, the report said overall percentage contribution of Federal Allocation to total receipts increased slightly from 47.08 percent in 2020 to 57.02 percent in 2021.

Also, the report said total loan of about ₦46.40bn reduced significantly by ₦13.59bn (45 percent) in 2021, from N29.99bn in 2020 to N16.40 billion in 2021, while total revenue decreased by ₦15.03bn (11.15 percent), from ₦134.86bn in 2020 to ₦119.83bn in 2021.

The decrease in total receipts, the report said, was attributed to a significant decline in other incomes by ₦12.56bn (74.21 percent), through not indicative of a poor performance in revenue generation.

The total statutory deduction from Federal Allocation to the State was ₦32.88bn, with foreign loan repayment, which was the only statutory deduction for the period, increasing by N1.34 bon (8.49 percent) in 2021.

The report revealed that Federal Allocation to the state, which increased by 7.61 percent during the period, was higher than the IGR, which increased by 23 percent from ₦24.85bn in 2020 to ₦30.83bn in 2021, including investment income as well as other income from the sales of fertilizer, dividends and interest received, etc.

While this showed an improvement in performance between 2020 and 2021, the report said it was still below what was achieved in 2018.

On loans, the report said it was the highest source of revenue for the State for the period, with about ₦46.4bn borrowed from local sources, in addition to about ₦14.2bn as grants from local and international donors.

Apart from a 13 percent derivation of N22.36bn, or 8.78 percent of total revenue, the State’s IGR was N55.68bn, or 21.86 percent of the total, while other incomes, consisting of investment income, aid, and grants

refunds, donations and interest earned totaled N20.78bn, or 8 percent, in addition to internal loans of N46.40, or 18.22 percent.

The State has a debt profile of N74.03bn as of June 30, 2023, according to the debt data on the DMO website.

The report recommended that the State should continue to innovate towards improved IGR potentials to guarantee future self-sufficiency while ensuring periodic reviews of its revenue drive strategies to ascertain if they were yielding the desired results that would bring about sustainable revenue growth.

Also, the report urged the State to carefully review and identify areas of revenue leakages to develop and implement mechanisms aimed at closing all loopholes, while ensuring that the purposes for which loans are taken were carefully reviewed to ensure the facilities were not used for projects not self-financing either directly or indirectly.

Rivers

For Rivers State, the report showed that with total revenue receipts for the period at ₦865.72bn, allocation from the Federation Account was the most significant source for the State, accounting for about 37.28 percent of the total inflows.

Other sources of revenue receipts, such as IGR, the report said, also contributed materially to total receipts, with IGR accounted for 28.99 percent of the inflows, and loans 32.72 percent.

The report said Federal Allocation, which increased by ₦18.67bn (12.28 percent) in 2021, was driven by VAT receipts, which increased significantly by ₦24.55bn (114.89 percent) as a result of more collections after the disruption caused by the COVID-19 pandemic in 2020.

Also, the report said IGR increased by ₦22.06bn (19.28 percent) from ₦114.46bn in 2020 to ₦136.53bn, while other exceptional income outside the ordinary activities of the State represented only 1.01 percent of total receipts.

In addition, the report said the State obtained new loans in both years, amounting to ₦283.25bn, with the loans obtained in 2021 representing over 5116 percent of the loans taken in 2020, as the State embarked on road construction and other capital projects. Overall, loan receipts were 32.72 percent of the total receipts.

In terms of statutory deductions from the Federal Allocation to the State, the report said due to its obligation to make monthly payments for past financial transactions that resulted in an Irrevocable Standing Payment Order (ISPO) issued to the FGN, a total of ₦18.42bn was a deduction from federal allocation to the state during the period.

A breakdown of the deductions showed that FGN bonds and foreign loans, amounting to about ₦7.36bn and ₦6.08bn respectively were major, while other deductions included CBN budget support and deduction for Excess Crude Account (ECA) loan.

Findings by the report showed that the State has continued to improve its IGR over the years. Federal Allocation fluctuated during the same period, although it remained the highest revenue to the State.

Also, the report showed that the State’s borrowing increased significantly in 2021, with loans from internal sources amounting to N258.3bn compared to N24.9bn obtained in 2020.

Rivers State received about N22.36bn as 13 percent derivation revenue, which accounted for 8.78 percent of its total revenue, in addition to IGR of N55.68bn, or 21.86 percent of the total, with other incomes consisting of investment income, aid and grants, refunds, donations and other interests earned totaling N20.78bn, or 8 percent of the total, in addition to internal loans of N46.40bn, or 18.22 percent of the total revenue.

The report recommended that the State should continue to improve on its IGR collection to move towards self-sufficiency while ensuring that its loan level be closely monitored so that they do not rise to a level where they become a burden to the State.