Nigeria is exploiting the opportunities created by the effective implementation of the Petroleum Industry Act (PIA) to restore the growth of the upstream petroleum industry, the Nigerian Upstream Petroleum Regulatory Commission (NUPRC) has said.

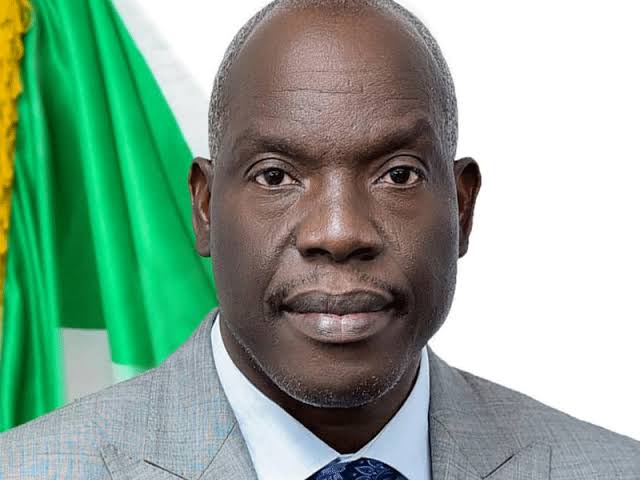

Speaking at the 6th Nigeria International Energy Summit 2023 n Abuja on Thursday, the Commission Chief Executive, Gbenga Komolafe, disclosed that the country’s total annual upstream capital expenditure (CAPEX) declined by 74 percent from $27 billion in 2014 to less than $6 billion in 2022.

Komolafe, who delivered a keynote paper titled: “Pivoting Upstream Petroleum Regulations & Investments”, blamed the decline on the massive drop in investments in the country’s oil and gas industry as a result of regulatory uncertainty, inadequate funding of fossil fuel development projects as a result of energy transition and the impact of COVID-19 pandemic.

Due to the uncertainty in the regulatory environment in the oil and gas industry, Komolafe said most of the international oil companies (IOCs) deprioritized their investment portfolios in Nigeria, leading to the redirection of their CAPEX to other countries.

With increasing competition from regional peers, he said the proportion of the overall upstream investment attracted by Nigeria was further eroded, with the under-investment reflected in the country’s rig count.

“On average, Nigeria had 17 active oil rigs in 2019, representing one of the highest counts on the African continent. Nigeria’s average rig count declined to 11 in 2020, seven in 2021, 10 in 2022,” Komolafe said.

With policy transformation in the industry by the present administration, particularly with the enactment of the PIA (2021), which has brought landmark reforms in the industry, the NUPRC Chief said the country’s rig count recently grew to 24 in April 2023.

Compared with other member countries of the Organisation of Petroleum Exporting Countries (OPEC), Komolafe said countries like Iran, Iraq, Algeria, Libya, Angola recorded 117, 62, 31, 12 and nine active rigs respectively against Nigeria’s 13 as of February 2023.

Noting the growth in the industry rig count as indicative of a positive signal of new investments trickling into the country, Komolafe said this is a reflection of investors’ acceptance of NUPRC’s effective implementation of the PIA.

With rising energy prices in the last two years, he said global oil and gas industry is experiencing a boom that could be directed to capital investment in upstream industry, which outlook he projected to remain positive into the near future.

Nigeria, he said, must leverage on the rising energy price situation as an opportunity, by doing all that is necessary to attract more investments and revive the Nigerian upstream sector.

On de-funding of fossil fuel projects, he noted the upsurge in global investments in energy Research and Development and innovations in renewables and clean energy technologies, as governments fast-track their moves towards Net Zero Emissions by 2050.

Between 2021 and 2022, he said the annual global investments in clean energy sources and technology specifically relevant to the energy transition surged by 31 percent, representing the largest annual investment increase since 2010.

He underlined the need for Oil and Gas producers in Africa to embrace the reality of green energy transition, by taking a strategic position to leverage on the emerging opportunities.

With the Russia-Ukraine war posing a threat to the global energy transition plans and provoking global energy crisis characterized by high-energy prices, market volatility and disruptions to energy supply, the NUPRC boss urged Africa to take steps to develop cleaner fossil fuel to offset the deficits in the world energy supply.

With a total of over 620 trillion cubic feet of natural gas reserves, he said all Africa required was the right legislative framework and a change in policy direction in order to design a system that would foster energy sufficiency, while also attending to the urgency of ending carbon emissions.

With the launching of the Africa Carbon Markets Initiative (ACMI) to help shape and harness Africa’s potential of carbon markets, increase the production of African carbon credits and ensure carbon credit revenues were transparent, equitable, and create jobs, he urged industry stakeholders to embrace climate action initiatives targeted at emissions reduction.

The NUPRC, he said, has responded to the demands of the energy transition and the global footprint, by embarking on the development of a regulatory framework for carbon-pricing system to make businesses pay for their emissions and incentivize emission reductions through carbon credits.

Apart from establishing a new Energy Transition & Carbon Monetization Department, to regulate the oil and gas carbon market, he said other policy actions and measures were in the pipeline to be unveiled soon.

Komolafe, who acknowledged that Nigeria was already charting a new course in the upstream petroleum sector, said through effective implementation of the PIA, the Commission was developing regulatory instruments to promote transparency, efficiency, and innovation for sustainable development of Nigeria’s hydrocarbon resources.

Benchmarking international standards h said NUPRC’s regulatory focus was targeted at achieving reduced unit cost per barrel, transparency in hydrocarbon accounting, operational efficiency, conducive operating environment, increase in oil and gas reserves and production as well as reduction in carbon footprint

Reviewing the achievements of the Commission, Komolafe said within the last 20 months five regulations have been gazetted, while 13 fresh regulations are currently under review by the Federal Ministry of Justice, with another six at consultative stages with industry stakeholders.

Also, he said the Commission is currently engaging all lease holders on their natural gas elimination and monetization plans to ensure compliance with the relevant sections of the PIA towards boosting supply to the rapidly growing gas market.

“With a proven gas reserve base of 208.62TCF (as of 1st January 2022), we are on track to increase our reserves volumes to 220TCF in less than 10 years and 250TCF thereafter,” he said.

On opportunities for investment in the energy sector, Komolafe said apart from growing gas reserves and production to meet future domestic energy demand and international market, the country must create the infrastructure to utilise the gas within the country as well as earn revenue for further development of the renewable resources.

To promote gas utilization plans in the upstream sector, he said the Commission was enforcing the relevant statutory provisions in the PIA to attract the multiplier economic benefits to the Nigerian economy.

Apart from intensifying efforts towards eliminating flared gas while arresting methane and other fugitive gas emissions, government was also taking steps to harness more gas for domestic utilization as Liquefied Petroleum Gas (LPG), feedstock for power generation plants, fertilizer plants and petrochemicals.

Further investments opportunities, the head of the regulatory agency said, have been created with the successful completion of the 2020 Marginal Field Bid Round, with the Commission engaging the awardees to ensure early field development.

Similarly, he said the ongoing mini bid round for seven Deep Offshore Petroleum Prospecting Licences (PPLs) expected to be concluded early Q3, 2023 would boost the country’s reserves.

He disclosed that the National Gas Flares Commercialization Programme (NGFCP) 2022 bid process for 49 flare sites with a combined volume of about 300 million standard cubic feet of gas per day would be concluded in April 2023.

“The flare commercialisation initiative is aimed at driving Nigeria’s target to end routine gas flaring within this decade, supporting the Nigeria Energy Transition Plan (ETP) and creating value from its gas resources.

“In this gas flare commercialisation journey, the Commission has partnered with relevant global players to leverage the carbon credit market mechanism that should improve the bankability of some of the flare elimination projects,” he said.

The theme of the Summit was “Global Perspectives for a Sustainable Energy Future.”