By Bassey Udo

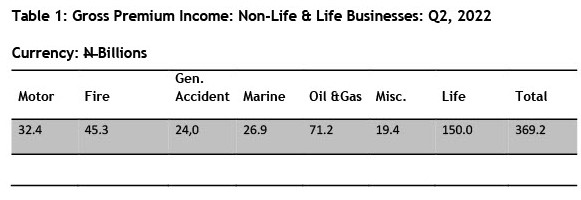

The Nigerian Insurance Industry maintained the positive performance trend recorded in the first quarter, with gross premium income of about N369.2 billion, or 20.1 percent growth rate in the second quarter compared to the same period of the previous year, the National Insurenace Commission (NAICOM) has disclosed.

The Commission, which disclosed this in its latest market review report, said the performance showed an impressive 65 percent quarter-on-quarter performance.

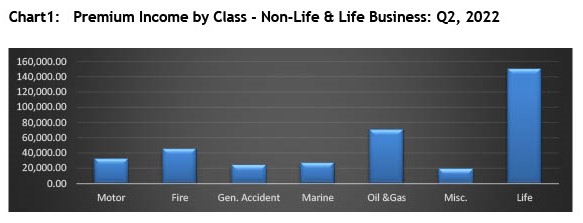

The report said Sectoral performance showed Life Insurance Motor insurance recorded the highest performance with an incN150 billion, followed by Oil & Gas Insurance with N71.2 billion, and Fire Insurance with N45.3 billion. The other sectors included Motor Insurance N32.4 billion; Marine Insurance N26.9 billion; General Accident Insurance N24 billion, and Miscellaneous N19.4 billion.

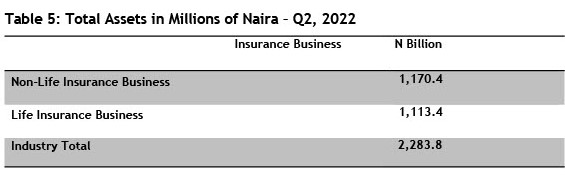

The market report showed the growth in the Insurance industry was higher than the national real Gross Domestic Product (GDP) of 3.5 percent during the same period, with total insurance asset, consisting Non-Life insurance (N1.170 trillion), Life Insurance (N1.113 trillion) at N2.284trillion.

The Non-Life sector of the industry maintained its lead at 59.3 percent of the total premium generated during the period, with the Oil & Gas sector driving the growth at 32.5 percent; followed by fire at 20.7 percent; Motor Insurance 14.8 percent; Marine & Aviation, Gen. Accident and Miscellaneous at 12.3 percent, 10.9 percent and 8.9 percent respectively.

.

On the other hand, the report said Life business recorded 40.6 percent of the insurance market production as its share contribution, gradually closes up. The share of Annuity in the Life Insurance at about 24.7 percent per cent, while Individual Life had a major driver at 41.8 percent of the premium generated during the period.

On Insurance claims, the report said the growth of the gross claims reported was about 0.2 percent during the quarter compared to the corresponding period of 2021, with gross claims at N174.8 billion, or 47.3 percent of all premiums generated during the period.

“This performance reflects the professional underwriting capacity of the industry as driven by the intensified regulatory activities of the Commission,” the report said.

The net claims paid on the other hand stood at about N148.2billion, signifying an 84.8 percent of all gross claims reported during the period, while Life Insurance business recorded a near perfect point of about 88.90 percent claims settlement as against the reported claims, while non-life segment stood at about 76.8 per cent.

The percentage of incurred claims as against reported, the report said, mirrored the market retention view during the period, with Motor Insurance retaining its lead position of the claims settlement ratio of 92 per cent.

The report said progress was however more noticeable in the Oil & Gas with an 85.7 per cent of claims settlement ratio, an increase of some 43 points compared to its position of 42.8 percent recorded in the corresponding period of 2021.

Miscellaneous insurance also posted about 61.9 percent, higher than 44 percent paid claims ratio, compared to its corresponding period of 2021, while General Accident (75 percent), Fire (76.2 percent) and, Aviation & Marine (61.9 percent) followed in that order.

The performance in the Oil & gas sector in terms of claims settlement, the report said, recorded some improvement when compared to quarter two of the previous year, a sustained market development and growing confidence in the industry would eventually improve the negative peculiarities and challenges of that section of the market.

In terms of profitability of the Insurance sector, the report said the Insurance market remained profitable during the period, recording an overall industry average of about 56.9 percent, maintaining a relative position of 57.7 percent recorded in the corresponding period of preceding year.

The Non-Life segment loss ratio stood at 43.6 percent, while the life business stood at about 68.5 per cent, depicting a less profitable scenario comparatively, over the same period.

The net loss ratios for non-life, bears an improved market image in the current period as compared to the preceding period when it was 48.2 percent.

Drivers of the loss experience are made up of some twelve underwriters with a record of loss ratios above 100 percent.

On market concentration in the Non-Life sector sustained its conducive and fair competitiveness, while also remaining skewed in the life segment of the market.

In the Life segment, top three institutions control about 45 per cent of the total Life market, while the top three driver firms of the non-life segment, retained a market control of about 26.9 percent.

An extension of assessment revealed that, about 80.4 percent of all Life business is controlled by the top ten players in the market, compared to about 60.2 percent in the prior period Year-on-Year.

-The top ten underwriters in the non-Life section of the industry contributed about 60.8 percent of the gross premiums income sustaining a similar scenario in the corresponding prior period.

Although the report said the report demonstrate fairly distributed market control and a less concentration risk in the market, the report said.

However, less than one per cent was the contribution of the least ten (10) players in both Life (0.13%) and non-Life (1.23 percent) segments of the market.