By Bassey Udo

In what experts described as the most aggressive monetary policy decision to rein in spiralling inflation and stabilise the country’s financial system and economy, the Central Bank of Nigeria (CBN) through its Monetary Policy Committee (MPC) raised monetary policy rate (MPR) popularly called interest rates from 14 percent to 15.5 percent as the country continues to wrestle with the impact of inflation and general economic decline.

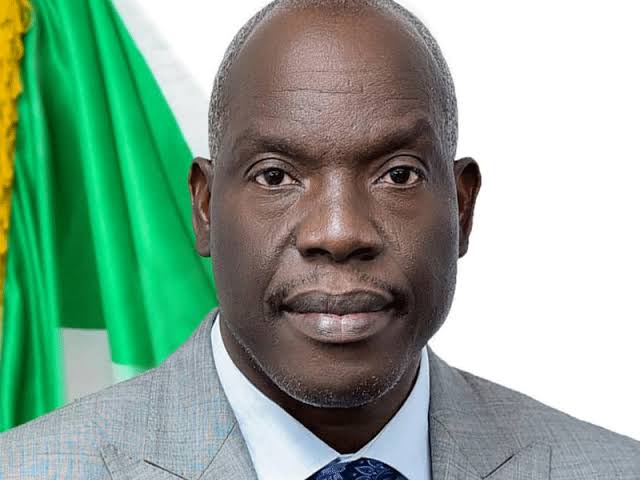

Briefing reporters at the end of the MPC meeting on Tuesday, the CBN governor, Godwin Emefiele, said the apex bank resolved to take tough decisions to halt the spiralling inflation, which rose to 20.52 percent in August from 19.64 percent in July.

Part of the tough decisions, he announced in the communique issued at the end of the meeting, included the upward review of the MPR to 15.5 percent, while retaining the asymmetric corridor at +100/-700 basis points around the MPR.

Also, the CBN governor said the Committee raised the cash reserve ratio (CRR) to a minimum of 32.5 percent, while liquidity Ratio was kept at 30.0 percent.

CRR is the level of savings retained by commercial banks with the CBN.

Emefiele said the CBN resolved to continue to raise interest rates as long as inflation continues to trend upwards.

He said using the interest rate hike was the easiest and most preferred option adopted globally in tackling inflation in the economy, as it would discourage money supply that drives inflationary trend.

“If you want to rein in inflation, the option to deploy is to raise the interest rate to a level that is equal or possibly higher than the inflation rate, so that inflation rate must lag policy rate,” Emefiele insisted.

He stressed that if the inflation rate does not lag the interest rate, it would become a negative interest rate and a disincentive to investors.

Emefiele said in view of that, as long as inflation keeps rising, not raising interest rate would retard growth and leave the people poorer than they could have been.

“Therefore it is imperative that the CBN must raise interest rate in order to rein in inflation.” the CBN governor explained.

He, however, admitted that though raising interest rates may retard growth all the same, but the reason for raising interest rates is not to help slow down inflation, but compensate for an aggressive rise in inflation.

If, in the alternative the CBN does not raise the rate, he said consumption and expenditure would be affected, because the purchasing power of individuals would be eroded or dissipated.

His argument was that the quantity of goods people would be able to buy would also shrink and this would invariably increase the level of poverty in the economy.

“Therefore, you don’t have a choice, but to raise interest rates,” he said, giving justification with a study he said the apex bank conducted, which showed that once inflation trends above 12 or 13 percent, it would definitely retard growth no matter how one tries to rein it in.

In view of the aggressive manner in which inflation has continued to rise in the last four months, he said it would be difficult for the CBN not to adopt an equally aggressive approach as it has done.

On the efforts by the government to reflate the economy, the CBN goveror said the MPC noted the injection of over N9trillion into the economy in the last three years, in addition to offering 2- year moratorium for 10-year long-term loan facilities to help engendered growth.

However, he said in light of the persisting pressures on inflation, the Committee encouraged the CBN to maintain a close watch on the inflationary implications of the interventions.

Noting the moderate downturn in the equities market, he attributed it to a continued outflow of portfolio capital as investors re-assign their portfolios to more attractive US dollar denominated fixed income securities.

He said the MPC urged the government to continue to improve the ease of doing business in the country to retain the current patronage of foreign investors through sustained investor confidence in the Nigerian economy.

While applauding the CBN for its continued stringent regulatory measures over the banking system, he said this resulted in the progressive decline in the Non-Performing Loans (NPLs) ratio of the banking system despite the heightened macroeconomic uncertainties.

Defending the MPC’s decisions during the meeting, Emefiele said the CBN was concerned that within a four-month period, inflation had accelerated aggressively by 280 basis point from 17.71 percent in May 2022 to 20.52 per cent in August 2022.

“The Committee was thus, of the view that given the primacy of its price and monetary stability mandate, it was expedient that significant focus must be given to taming inflation.

“The Committee was therefore of the view that a hold or loosen option was not in consideration.” “This is also because a loosening will further widen the negative real interest rate gap and worsen the financial market conditions, as savings mobilization and investment inflows would decline further.

“It was also of the view that with the aggressive policy normalization in Advance economies, loosening the stance of policy would result in a sharp depreciation of exchange rate, leading to further hike in capital outflows.

“As regards a hold decision, this would mean a continuous deterioration in real earnings of fixed income earners and the livelihood of middle- and low-income households,” he said.

A tight policy stance, on the hand, Emefiele said, “would help consolidate the impact of the last two policy rate hikes, which is already reflecting in the slowing growth rate of money supply in the economy. It also felt that an aggressive rate hike would slow capital outflows and likely attract capital inflows and appreciate the naira.”

On the impact of the widening margin between the prevailing policy rate of 14 percent and the inflation rate of 20.52 percent, Emefiele said the MPC’s decision to loosen the policy rate was not considered, as this would be gravely detrimental to reining-in inflation.