By Bassey Udo

Concerned Nigerians who, all along, expressed doubts about the capacity of the newly enacted Petroleum Industry Act (PIA) to effectively regulate the country’s petroleum industry without undue interference, had another reason last Monday to feel justified with their sentiments.

Not that the legal provisions of the new regulation, which took almost 20 years of legislation to establish, are inadequate for the effective management of the industry, but because strong men who would not allow strong institutions to evolve and enforce the sanctity of the laws in regulating the industry are still alive and well.

When the PIA was signed into law by President Muhammadu Buhari last year, the expectation by most Nigerians was that the petroleum industry would immediately begin to function under its full regulation, independent of any external influences, or devoid of the discretion of strong individuals outside the established rules, due process and industry procedures enshrined in the new law.

However, barely a year into the implementation of PIA, the regulatory authorities, namely the Nigerian Midstream Downstream Petroleum Regulatory Agency (NMDPRA) and Nigerian Upstream Petroleum Industry Commission (NUPRC) have each faced battles with these strong men against their mandates and authority. While the NMDPRA buckled under the weight of the pressures, the NUPRC stood firm and valiantly defended its mandate.

Fuel subsidy as the first challenge

When the PIA was enacted, operations of the downstream sector of the petroleum industry were expected to have been deregulated immediately. Under the new law, only the dynamics of the market forces of demand and supply were supposed to determine the prices of petroleum products throughout the country.

By implication, the commencement of the implementation of the PIA meant the end of the era of the Federal Government subsidizing the distribution and supply of petroleum products across the country, which has caused the country enormous financial hemorrhage over the years.

However, due more to the need to pander to selfish political sentiments, rather than the overall interest of the people and the country’s economy, the provision in the PIA that supported the removal of subsidy in the pricing template of petroleum products in the country was suspended, initially for six months, and later indefinitely.

The NMDPRA lost the battle,by throwing the petroleum products consumers under the bus and refusing to resist government’s decision to sustain the fuel subsidy regime after the enactment of the PIA.

In July, at the public presentation of the draft 2023-2025 medium-term expenditure framework (MTEF)/fiscal strategy paper (FSP) in Abuja, the Minister of Finance, Budget & National Planning, Zainab Ahmed, said whether the fuel subsidy regime is removed or retained in the 2023 budget, the government would spend between N3.36 trillion to about N6.72 trillion.

Seplat Energy-ExxonMobil share sale as another challenge

Seplat Energy-ExxonMobil share sale as another challenge

Last Monday, another justification for the fears against the sanctity of the PIA played itself out in the intrigues and confusion triggered by three conflicting public statements originating from three key sources over the controversial sale of the shares and assets of Mobil Producing Nigeria Unlimited (MPNU), the Nigerian subsidiary of ExxonMobil Corporation, to Seplat Energy PLC. But the NUPRC won, because it decided to bite the bullet and defend the sanctity of the law it’s mandate is anchored.

Each of the statements claimed justification from their mandates enshrined in the PIA.

Earlier on Monday, Seplat Energy circulated to the media a statement by the Presidential spokesperson, Femi Adesina, on behalf of his principal, President Muhammadu Buhari purportedly granting ministerial consent for Seplat Energy to proceed with its acquisition plan in respect of the share capital of MPNU.

Adesina’s statement said the President gave his consent to the share purchase deal in his capacity as the Minister of Petroleum Resources as stipulated in the provisions of the PIA, apparently regardless of a subsisting dispute by the Nigerian National Petroleum Company Limited, which also has an interest in the sale.

Adesina’s statement read in part: “In his capacity as Minister of Petroleum Resources, and in consonance with the country’s drive for Foreign Direct Investment in the energy sector, President Muhammadu Buhari has consented to the acquisition of ExxonMobil shares in the United States of America by Seplat Energy Offshore Limited.

“Exxon Mobil had entered into a landmark Sale and Purchase Agreement with Seplat Energy to acquire the entire share capital of Mobil Producing Nigeria Unlimited from Exxon Mobil Corporation, Mobil Development Nigeria Inc, and Mobil Exploration Nigeria Inc, both registered in Delaware, USA. Considering the extensive benefits of the transaction to the Nigerian Energy sector and the larger economy, President Buhari has given Ministerial Consent to the deal.

“The President, in commitment to investment drive in light of the Petroleum Industry Act, granted consent to the Share Sales Agreement, as requested by the parties to the transaction, and directed that the approval be conveyed to all the parties involved.

“ExxonMobil/Seplat are expected to carry out operatorship of all the oil mining licenses in the related shallow water assets towards production optimization to support Nigeria’s OPEC quota in the short term as well as ensure accelerated development and monetization of the gas resources in the assets for the Nigerian economy. President Buhari also directed that all environmental and abandonment liabilities be adequately mitigated by Exxon Mobil and Seplat.”

The Share Sale Deal and NNPC dispute

In February 2022, Seplat Energy announced a $1.58 million deal to acquire the entire share capital of MPNU, subject to regulatory and ministerial approvals.

Seplat Energy confirmed it already signed a Sale and Purchase Agreement with ExxonMobil Corporation for the deal, in addition to other contingent considerations.

No sooner was the announcement by Seplat Energy made that the Nigerian National Petroleum Company (NNPC) Limited triggered a dispute.

No sooner was the announcement by Seplat Energy made that the Nigerian National Petroleum Company (NNPC) Limited triggered a dispute.

The NNPC has been the holder of the Federal Government equity interests in all the joint venture operations in Nigeria since the inception of all the international oil companies, including MPNU.

In its dispute, the management of NNPC argued that apart from its long history of joint partnership with the MPNU, the subsidiary’s assets in Nigeria were among its prime targets in its planned takeovers and acquisition following divestment plans by the IOCs from Nigeria. The NNPC said this was part of its preparations to bolster its capacity towards its then pending emergence as an independent national commercial oil and gas company under the regulation of the PIA and the Companies and Allied Matters Act (CAMA).

In kicking against the Seplat Energy deal, the NNPC, which emerged as a public liability company limited by share, by the enactment of the PIA in August 2021, pushed the argument that as a major partner in the NNPC/MPNU joint venture, ExxonMobil was entitled to have been given it the pre-emptive right-of-first-refusal to the sale of its shares in Nigeria.

In May 2022, the upstream petroleum industry regulator, the NUPRC said it received a letter from Seplat Energy confirming the ExxonMobil share sale deal. However, the Commission said the mandatory regulatory ministerial consent to formalize the deal was declined by the President in the overriding national interest. The Commission did not give any further details.

Meanwhile, the NNPC proceeded to file a case in the High Court of the Federal Capital Territory, Abuja to stop ExxonMobil from going any further with the transaction.

The thrust of NNPC’s application was for the court to halt the share sale/purchase process pending when an interpretation was given to the implications of its pre-emptive rights under its Joint Operating Agreement (JOA) with MPNU under arbitration.

In July 2022, the Court granted an ex-parte order of interim injunction in favour of the NNPC restraining ExxonMobil and its shareholders from completing the Share Sale and Purchase Agreement previously signed with Seplat Energy. Since then, the transaction was stalled.

Attorney General’s legal advice

However, it was learned that the legal advice was sought from the Attorney General of the Federation and Minister of Justice, Abubakar Malami, on the status of the transaction, vis-à-vis the dispute by the NNPC.

The issue in dispute was whether the transaction involved only the acquisition of the shares of MPNU by an investor and not an outright purchase of the entire MPNU’s assets.

If the former was the case, then the NNPC would have no grounds to claim entitlement to pre-emptive rights.

In giving his legal advice, Malami was said to have written to the President to advise him to go ahead and give his ministerial consent to Seplat Energy to conclude the deal, as the transaction was merely an acquisition of part of the equity holding in the NNPC/MPNU joint venture, which did not give the NNPC the ground to claim pre-emptive rights over

The ministerial consent was conveyed in a statement by the President’s spokesperson, Femi Adesina, who said the approval of the share sale/purchase followed the request by the parties to the transaction.

Clearly, the President acted ultra vires based on wrong legal advice. If the transaction was all about the mere acquisition of part of the equity holding in the NNPC/MPNU joint venture, and not outright purchase of the entire MPNU’s assets, why did the President approve that ExxonMobil/Seplat would “carry out operatorship of all the oil mining licenses in the related shallow water assets”?

Again, the powers of the Minister of Petroleum Resources to exclusively issue Ministerial consent to such transactions, regardless of the opinion of the regulatory agency, were only applicable under the provisions of the defunct 1969 Petroleum Act, which ceased to apply after the enactment of the PIA.

Under the PIA, the NUPRC, as an independent regulator of the petroleum industry, is the sole regulatory authority mandated to issue such consent in such transactions in consultation with the Minister of Petroleum Resources.

NUPRC asserts its mandate

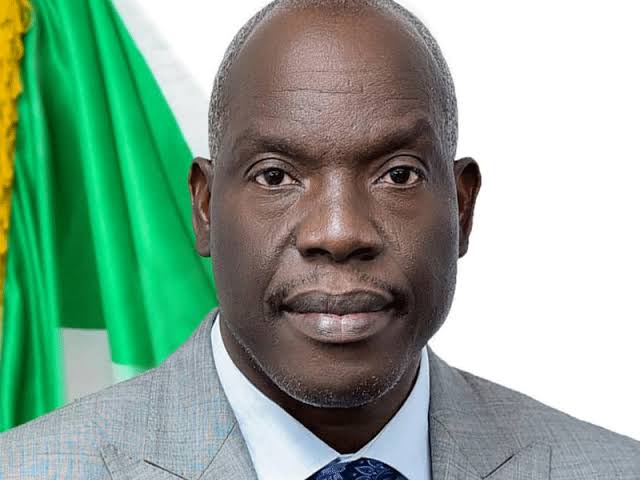

Aware of the powers of the regulator as vested by the PIA, the Commission, through its Chief Executive Officer, Gbenga Komolafe, on reading in the media about the President’s statement immediately issued a rejoinder, to reaffirm the position of the Commission that the status quo, which was the subsisting denial of ministerial consent, remained with respect to the Seplat Energy-ExxonMobil share acquisition deal.

Komolafe insisted that in line with the provisions of the PIA 2021, the Commission remained the sole authority to regulate such deals in the Nigerian upstream petroleum sector.

He said since the Commission had already communicated the decline of Ministerial assent to ExxonMobil based on the fact that the issue at stake was purely a regulatory matter, the status quo remained.

Under the PIA, Section 95, subsections 10, 14, and 15, the Commission acted within its powers by declining its consent to the deal, without prejudice to any other position, including that of the NNPC.

Also, Section 95, sub-section 10, which deals with the refusal by the Commission of an application for assignment or transfer of a petroleum prospecting license or petroleum mining lease, stipulates that the affected applicant should be informed of the reasons for the refusal and given reasonable time to make further representations, including those by third parties in respect of the application.

Section 95, sub-sections 14 and 15 of the Act addresses the core of the issue in contention in the Seplat Energy share acquisition deal.

It states: “For the purpose of this section, change of control means any person or persons acting jointly or in concert, to acquire direct or indirect beneficial ownership of a percentage of the voting power of the outstanding voting securities of the holder, by contract or otherwise, that exceeds 50 percent at any time.

“A holder of a petroleum exploration license shall not assign, novate or transfer his license or any right, power, or interest without prior written consent of the Commission.”

The acquisition of the entire assets of MPNU, reputed to be Nigeria’s second-largest oil and gas industry player, would have helped Seplat Energy become one of Nigeria’s largest independent energy companies with dual listing in the Nigerian and London Stock Exchanges.

Therefore, having communicated to ExxonMobil the reason its share sale was denied ministerial consent, the NUPRC acted within the law that defines its regulatory mandate by following strictly the due process.

The decision by the President to unilaterally reverse its earlier decision to decline his consent without reference to the regulatory authority impinged on the sanctity of the PIA. Perhaps, that was why the President immediately reversed himself again, by withdrawing the consent he gave on Monday to the Seplat Energy deal.

If the PIA must work, and be seen to be working, to effectively regulate the petroleum industry towards achieving set national objectives, strong persons in positions of authority must learn to avoid trampling on the independence of the regulatory body or undermining its powers to enforce the law without let or prejudice.

EDITOR’S NOTE: This report updated for factual accuracy.