MEDIATRACNET

Tax Credit Certificate for the construction of the multi-billion Naira Bonny-Bodo road and bridge in Rivers State was presented by the Federal Inland Revenue Service (FIRS) to the Nigeria Liquefied Natural Gas Limited (NLNG) on Thursday.

The NLNG was one of the companies that undertook the construction of roads and other infrastructures under the Road Infrastructure Development and Refurbishment Investment Tax Credit Scheme.

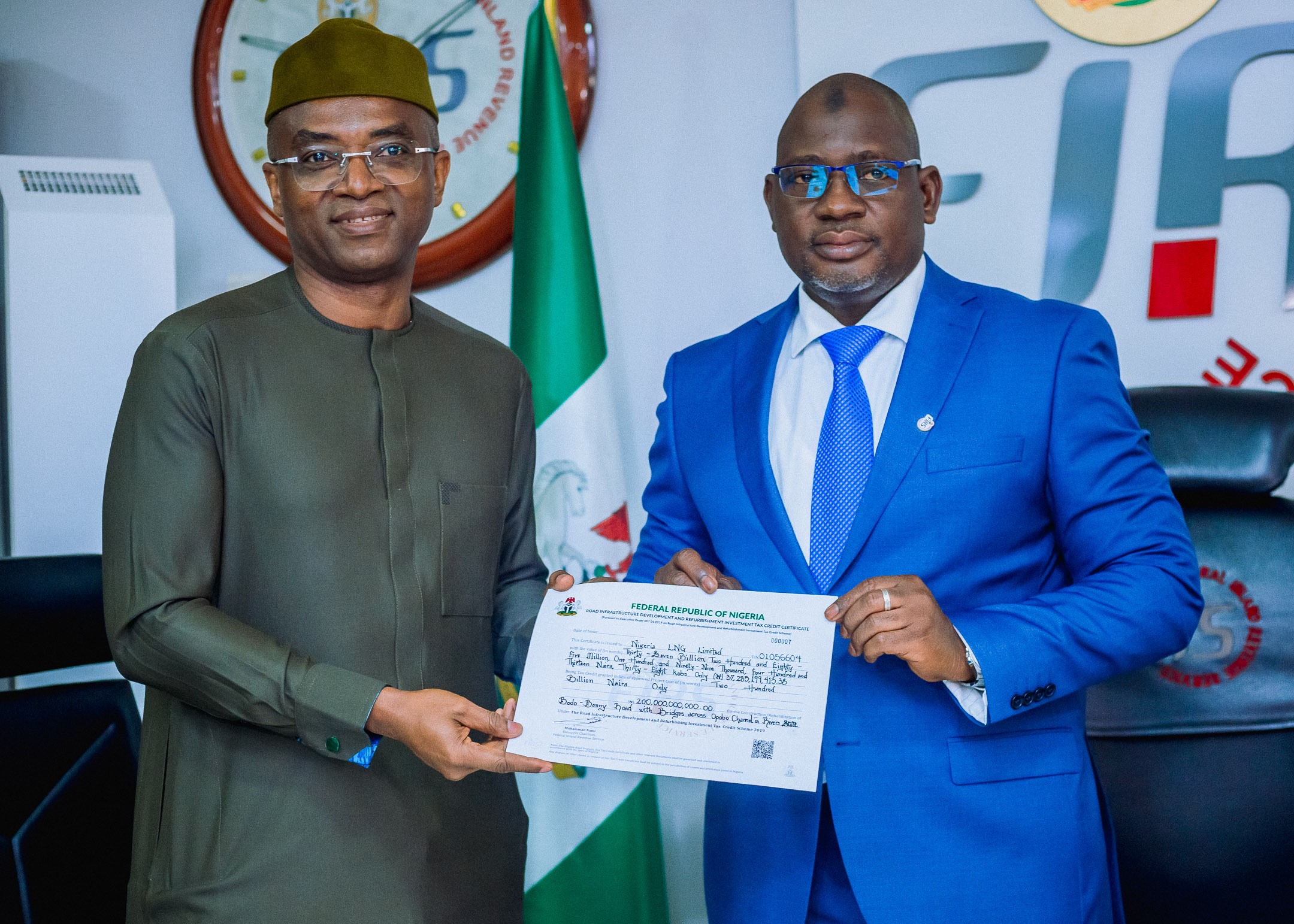

The certificate was presented to the Deputy Managing Director of the NLNG, Olalekan Ogunleye, who represented the CEO NLNG, Philip Mshelbila at the FIRS Headquarters in Abuja.

The Executive Chairman, FIRS, Muhammad Nami, who made the presentation of the Tax Credit Certificate, commended the NLNG for its increased investments in the country.

Nami said the FIRS has faith in the NLNG, in view of the increased investments the company was making in the country, adding that the FIRS was optimistic that the Train 7 Project would be completed for it to join the country’s tax revenue streams.

The FIRS Chairman said the Service was improving its relations with key stakeholders in the economy through building a customer-centric tax authority for improved revenue generation.

To efficiently deliver on its mandate, Nami said the Board and top management of the Service was focused on the strategic action areas, namely energizing its consultations and regular engagements with stakeholders; building a customer-centric and data-centric organization, while also restructuring the administrative framework and processes of the Service; driving towards full automation of core tax operations.

The FIRS started with the development and deployment of an in-house digital solution – The Taxpromax Solution allows taxpayers to sit in the comfort of their offices or homes to file returns, pay taxes and conduct all forms of tax processes with us.

At the heart of our customer-centric reforms in the FIRS, Nami said, was a multi-lingual Call Centre set up for inquiries and report from taxpayers.

As a result of these strategic moves, he said the FIRS recorded an unprecedented collection of over N6trillion in 2021, adding that the Service was determined to achieve higher performance this year.

He said with taxpayers like the NLNG, the FIRS has no doubt that it can achieve its targets, assuring that the Service was ever ready to attend to any issue that would enable taxpayers comply with statutory tax obligations.

In his remarks, the CEO NLNG, Philip Mshelbila, said as a major contributor to the country’s economic development, the company was working towards building a better Nigeria.

Mshelbila who was represented by the Deputy Managing Director of the NLNG, Olalekan Ogunleye, also commended the FIRS for being at the forefront of economic resuscitation and progress the country was experiencing.

He expressed appreciation for the expedited issuance of the tax credit certificate by the FIRS, noting that tax credit was in relation to the Bonny-Bodo road which he described as a landmark project and a pilot scheme under the initiative.

“This would be the first time the Island of Bonny will be linked by road to the rest of the country. And this is very significant to the development and advancement of the country because it will open new opportunities for economic activity,” Mshelbila said.

The Road Infrastructure Development and Refurbishment Investment Tax Credit Scheme is a public-private partnership scheme approved by President Muhammadu Buhari under Executive Order 007, in January 2019.

The scheme enables the Federal Government to leverage private sector capital and efficiency for construction, refurbishment and maintenance of critical road infrastructure in the country.

Under the Scheme, participants are entitled to tax credits against their future Companies Income Tax (CIT) to the tune of the project cost incurred in the construction or refurbishment of eligible roads.

The Nigerian National Petroleum Company (NNPC) Limited, MTN, Transcorp Group, Access Bank, GZI industries, among others, are some of the entities currently participating in the Road Infrastructure Tax Credit Scheme of Executive Order 007.