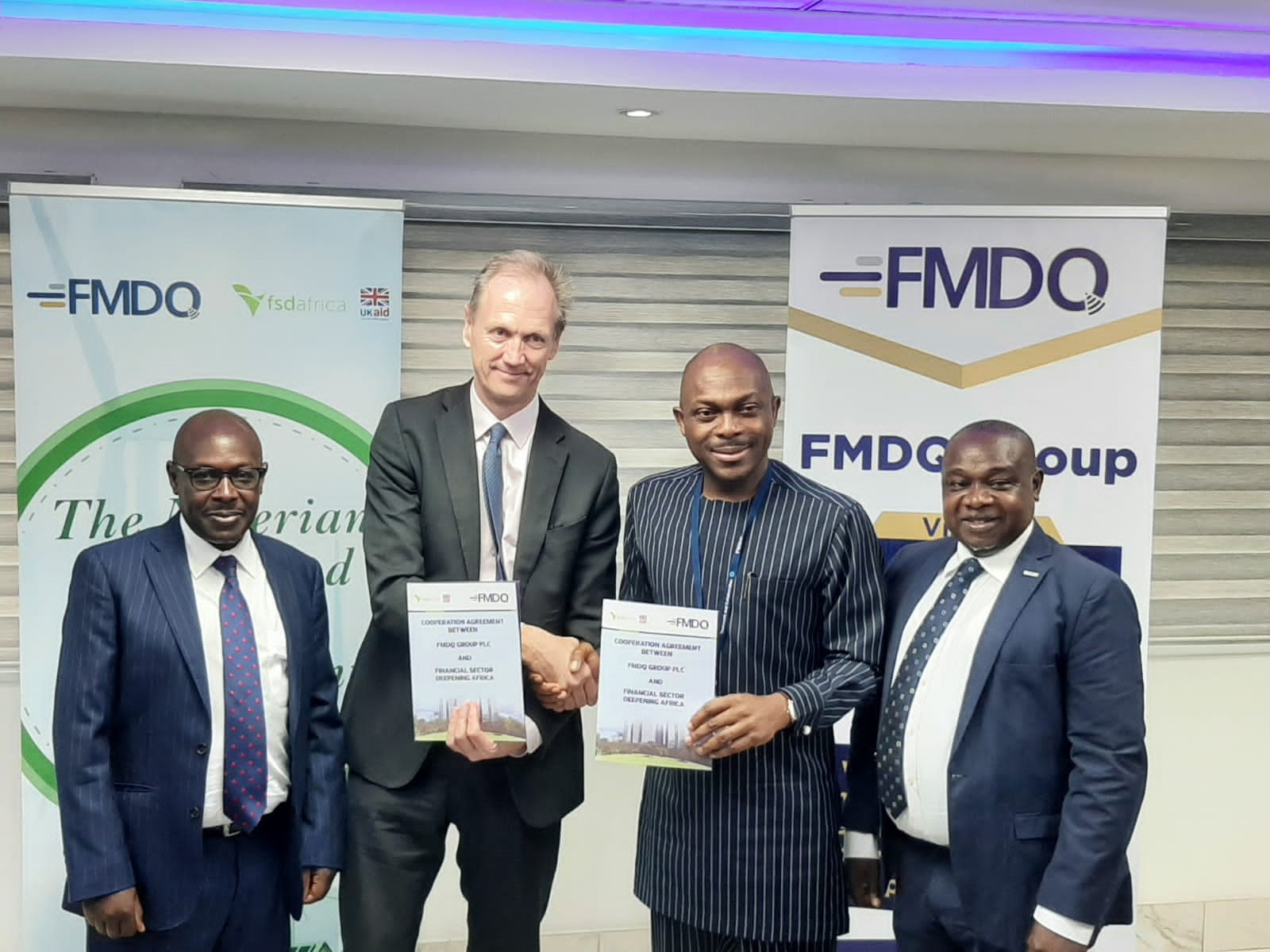

PHOTO CAPTION

FSD Africa CEO, Mark Napier, with FMDQ officials at the MOU signing

Nigeria’s financial markets on Monday got funding support from a UK government funded specialist development agency, Financial Sector Deepening (FSD) Africa, to help reduce poverty and strengthen financial markets across sub-Saharan Africa.

The support is part of a series of commitments by the agency announced as part of a two-week trip led by senior leaders from the UK-Aid funded agency in collaboration with Nigerian partners.

These partners included the Lagos State Government, the National Insurance Commission (NAICOM) of Nigeria, Infracredit, FMDQ, the UN Environment Programme’s Principles for Sustainable Insurance Initiative (PSI), and BFA Global.

From progress in implementing green bonds to opportunities for the local pension sector and solutions to help the country’s insurance industry respond to climate change, the initiatives would enhance the strength and health of Nigeria’s financial markets, building the foundations for a stronger more resilient national economy.

During a meeting with the Lagos State Governor, Babajide Sanwo-Olu, the agency reviewed the progress by the Lagos State Green Bond Issuance and other sustainability-linked debt securities towards achieving the global Sustainable Development Goals (SDGs) and support infrastructure and social development for Lagos State.

The agency also reviewed the progress on the R3Lab implementation in collaboration with National Insurance Comission (NAICOM) and the UN Environment Programme’s Principles for Sustainable Insurance Initiative (PSI) to improve the effectiveness of regulation in the insurance sector.

The initiative would deliver capacity-building and exchange programmes, learning resources, and forums for insurance supervisors. R3Lab is being implemented across the continent.

The support is expected to also promote Fintech and Climate Resilience Startup Challenge, an initiative to shine a spotlight on innovative solutions to build climate resilience.

In addition, local start-up, Soso Care , a micro mobile health insurance startup to enable people to pay health insurance with recyclable waste, was awarded $5000, as part of the challenge.

Besides, D-Olivette, which provides a decentralized energy solution for rural, off-grid, and agrarian communities, and Salubata, which creates bespoke shoes from recycled plastic waste, and Foodlocker, which provides a platform to link smallholder farmers with markets, were the other finalists.

The Nairobi Declaration on Sustainable Insurance is a continental commitment by African insurance industry leaders to support the achievement of the SDGs.

It brings together local and international insurance firms to promote the achievement of SDGs and make it easier for them to understand the commitment to support the achievement of the SDGs. m

m

The Report on the Launch of Nigeria Green Bond, which provided an update on the development of a green bond market in Nigeria, found that Nigeria has continued to lead the continent in the development and issuance of green bonds.

The report showed that to date, about N49.19 billion has been raised from domestic private investors in three different issuers through support from the programme.

In addition, the report said 500 capital market participants have benefited from training programmes, with two local organisations, licensed as green bond verifiers in Nigeria.

On the Roundtable with Pension Fund Administrators, FSD Africa held a roundtable with Pension Fund Administrators, led by the Pension Fund Operators Association of Nigeria (PENOP), where stakeholders discussed, among other things, diversifying investments from the usual government securities and investing in innovative instruments, to be de-risked by FSD Africa and partners.

The stakeholders also looked at challenges and solutions around mobilising domestic pension fund assets to provide long-term finance to support Nigeria’s economic development.

To unlock climate aligned local currency infrastructure bonds, FSD Africa and Infracredit signed a Technical Assistance Agreement under to provide funding for technical assistance to support pre-feasibility studies as well as the pre-transaction and transaction costs, including the design of innovative financing solutions for eligible projects that could issue climate-aligned local currency infrastructure bonds.

The successful implementation of the project would enable up to ten climate aligned infrastructure projects reach financial close, support new job creation and enable more capital markets instruments to be issued to institutional investors.

lFor the CEO of FSD Africa, Mark Napier, as Africa’s largest economy and country, in terms of population, stronger and more robust financial markets are critical for Nigeria’s growth and prosperity.

lFor the CEO of FSD Africa, Mark Napier, as Africa’s largest economy and country, in terms of population, stronger and more robust financial markets are critical for Nigeria’s growth and prosperity.

“FSD Africa remains a committed partner for strengthening Nigeria’s financial market, and we are thankful to our partners for their continued efforts and collaboration to unlock new pathways to prosperity and resilience for Nigerians,” he said.

The Deputy High Commissioner, UK High Commission in Nigeria, Ben Llewellyn-Jones, said: “Nigeria’s incredible capacity for innovation and entrepreneurship is powering a new era of economic growth that, with the right ingredients, can bring wealth and stability to more Nigerians than ever before.”

He said he was proud that through the work of organisations like FSD Africa and its partners, the UK government was helping get those ingredients in place.

“Core to everything, are effective financial markets, with the capacity to help scale-up businesses, insure against unforeseen risks, and energize the emergence of a sustainable economy,” he said.

Commissioner for Insurance/CEO, NAICOM, Thomas Sunday, said: “We recognise the role of a thriving insurance sector in supporting steady economic growth. Through the initiatives announced today, I have confidence that Nigeria will be a regional leader in providing innovative insurance products and distribution channels, enabling wider insurance coverage across the country.”

The Chief Executive Officer of InfraCredit, Chinua Azubike, disclosed that to date, InfraCredit’s guarantees have enabled the issuance of up to $200million of local currency infrastructure bonds

However, he said an increasing pipeline of climate-aligned infrastructure projects were constrained by limited financial resources dedicated to deliver well-structured projects that could access the debt capital markets.

InfraCredit’s collaboration with FSD Africa, through technical assistance support, he said, would also involve the design of an innovative financial solution that would catalyse more bankable climate-smart infrastructure projects.

Besides, he said InfraCredit’s guarantees would accelerate the issuance of credit worthy local currency infrastructure bonds to domestic institutional investors, thereby deepening the debt capital markets in Nigeria.