MEDIATRACNET

The three tiers of the government, namely federal, States and Local Councils shared a total of N675.946 billion as allocation for November 2021, the Federation Accounts Allocation Committee (FAAC) hss said.

The committee disclosed this at the end of its virtual meeting on Friday.

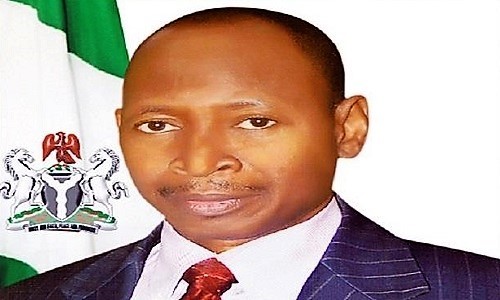

The meeting presided by the Accountant General of the Federation and Head of the Treasury, Ahmed Idris, was participated by members which consist of the Commissioners of Finance and Accountants General of the 36 States of the Federation.

The Committee said in a communiqué issued at the end of the FAAC meeting for December 2021 that the N675.946 billion total distributable revenue comprised of statutory revenue of N488.674 billion and Value Added Tax (VAT) revenue of N182.678 billion, in addition to Exchange Gain of N4.156 billion and recovered excess bank charges of N0.438 billion.

Details of the communique showed the gross revenue available for distribution from the Value Added Tax (VAT) was N196.175 billion, which was higher than the N166.284 billion available in the month of October 2021 by N29.891billion.

The Communiqué disclosed that in November 2021, Petroleum Profit Tax (PPT), Oil and Gas Royalties, Companies Income Tax (CIT) and Value Added Tax (VAT), increased remarkably, while import and excise duties increased marginally.

About N5.650 billion allocation to the North-East Development Commission (NEDC) and N7.847 billion cost of collection were deducted from the N196.175 billion gross Value Added Tax (VAT) revenue, resulting in the distributable Value Added Tax (VAT) revenue of N182.678 billion.

In November 2021, the Committee said total deductions for cost of collection by the various revenue collection agencies, including Department of Petroleum Resources (DPR), Federal Inland Revenue Service (FIRS) and Nigeria Customs Service (NCA), was N30.957 billion.

Also, the total deductions for statutory transfers, refunds and savings was N136.908 billion, while the balance in the Excess Crude Account (ECA) was about $35.365 million.

From the total distributable revenue of N675.946 billion, the Federal Government received N261.441 billion, the State Governments N210.046 billion and the Local Government Councils received N155.456 billion.

About N49.003 billion was shared to the relevant States as 13 percent derivation revenue.

From the distributable statutory revenue of N488.674 billion was available for the month, the Federal Government received N231.863 billion, the State Governments N117.604 billion and the Local Government Councils N90.668 billion, with about N48.540 billion shared to the relevant States as 13 percent derivation revenue.

From the N182.678 billion distributable Value Added Tax (VAT) revenue, the Federal Government received N27.402 billion, the State Governments received N91.339 billion and the Local Government Councils received N63.937 billion.

From the total Exchange Gain revenue of N4.156 billion, the Federal Government received N1.946 billion, the State Governments N0.986 billion, the Local Government Councils N0.761 billion and N0.463 billion was shared to the relevant States as 13 percent derivation revenue.

From the N0.438 billion recovered excess bank charges, the Federal Government received N0.231billion, the State Governments received N0.117billion and the Local Government Councils received N0.090 billion.