Nigerians are in for difficult times ahead as the Federal Government has adjusted the price of premium motor spirit (PMS), popularly called petrol, by more than 31.24 percent.

The latest guide to the petrol pricing template by the Petroleum Products Pricing Regulatory Agency (PPPRA) for March 2021 shows the price of the commodity has been reviewed by about N50.61, from the current level of N162 per litre to an average of 211.11 per litre.

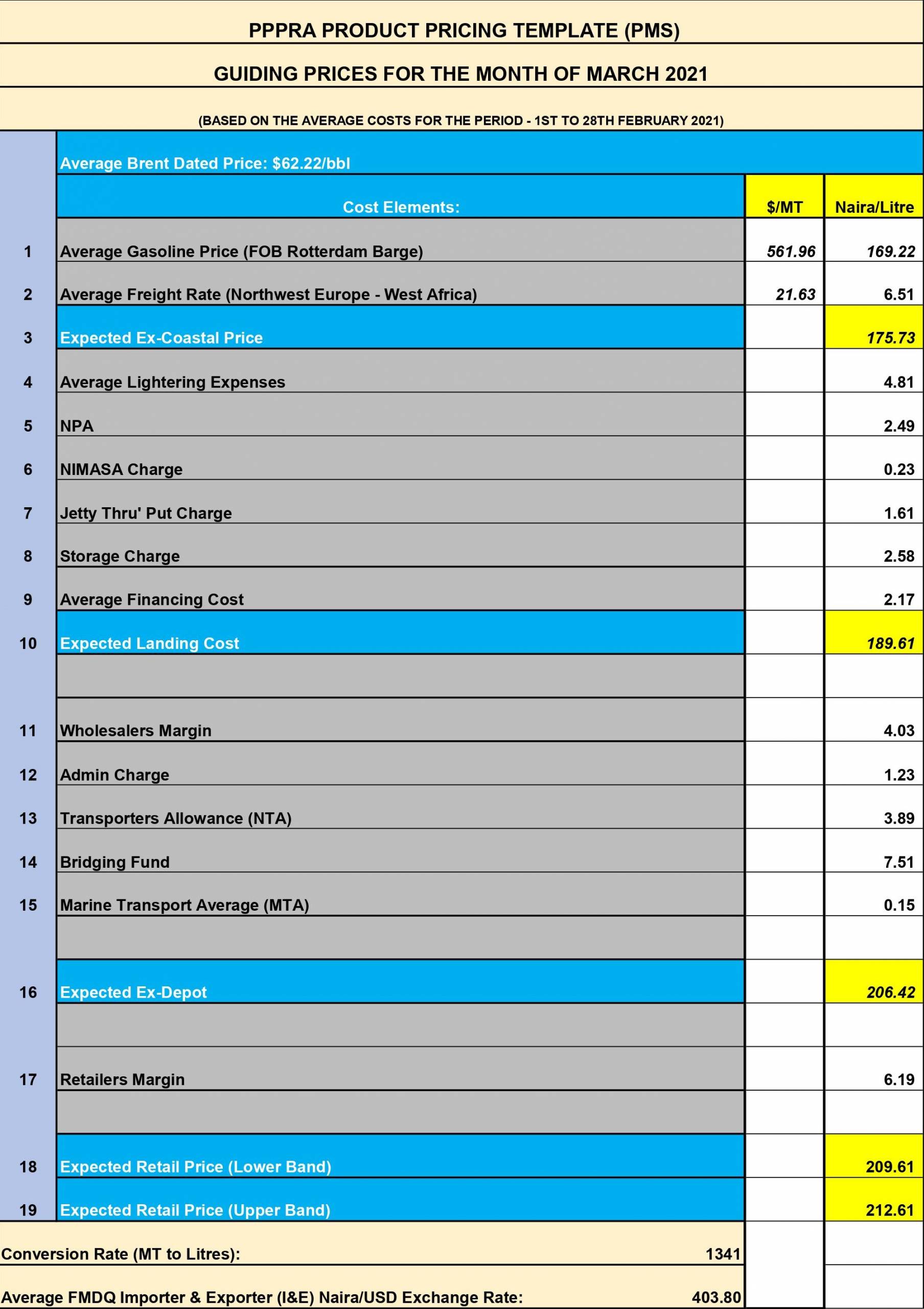

The pricing template for the period, February 1 and 28 2021, published on the petroleum products pricing regulatory agency’s website based on the average costs of imported petroleum products puts the lower band of the new fuel price for the month at about N209.61 per litre and upper band of N212.61 per litre. The computation is based on the approved average importer & exporter (I&E) Naira exchange rate per dollar of N403.80.

In Nigeria, an adjustment to the price of petrol fuels the inflation of prices of all other commodities, goods and services, as the country’s economy, from transportation to food businesses, depend on petrol to function.

PPPRA Pricing template

A review of the pricing template showed the average price per ton of the commodity at about $561.96, or N169.22 per litre, while the average freight rate coat (North-West Europe to West Africa) of about $21.63 per ton, or N6.51 per litre. This translates into an expected ex-coastal price of about N175.73 per litre.

Further analysis of the component charges in the pricing template showed that average littering expenses were put at about N4.81 per litre; Nigerian Ports Authority (NPA) charge N2.49 per litre; NIMASA charge N0.23 per litre; Jetty Thru put of N1.61 per litre and Storage charge of N2.58 per litre and average finance cost of N2.17 per litre, translating to an expected landing cost per litre of N189.61.

When other component charges are factored into the price computation, including the wholesale margin of N4.03 per litre; administration charge of N1.23 per litre; transporters’ allowance (NTA) of N3.89 per litre; Bridging Fund cost of N7.51 per litre and Marine transport average (MTA) of N0.15 per litre, the expected ex-depot price for wholesale products marketers would be N206.42 per litre.

With the addition of retailers’ margin of N6.19 per litre would bring the expected retail price (lower band) N209.61 per litre and expected retail price (upper band) N212.61 per litre, with the.

A hint of price hike

Last week, in the wake of the sudden return of long queues at most filling stations across the country, speculations were rife that the government was contemplating fresh adjustment in petrol prices in the country on March 1.

But afraid of a possible backlash by a protest by organized Labour, the government perished the idea, apparently looking forward to a more auspicious moment.

However, the Nigerian National Petroleum Corporation (NNPC) swiftly dismissed the speculation, describing it as an unfounded rumour peddled by some marketers interested in profiteering.

The NNPC spokesperson, Kennie Obateru, said the government was not contemplating any increment in the retail price of PMS.

He said any such decision would jeopardize the government’s ongoing engagements with organized labour and other industry interest groups on an acceptable framework for fuel pricing in the country.

Marketers hinted at new price

However, in an interview with MEDIATRACNET, some petroleum products marketers familiar with the situation hinted that the only price they would be able to break even and remain in business in the face current market realities was an average price band of between N210 and N215 per litre.

The marketers said at the current retail price of petrol of at N162 per litre, marketers would be driven out of business, as the prevailing landing cost of the product was about N174 per litre.

“When all other components in the fuel pricing template are taken into consideration, the appropriate retail price for petrol today at the filling stations should be between N210 and N215 per litre for the marketers to break even and stay in business,” one of the marketers told our reporter.

He requested that his identity should not be revealed because of the sensitive nature of the information.

It is not clear what the reaction of organized Labour would be over the latest development, as the Nigeria Labour Congress (NLC) and its affiliates have never disguised their opposition to any increase in the price of petrol.

Since the government has been meeting with the organized Labour on unresolved issues bordering fuel pricing, Nigerians have been anticipating that the outcome would likely be another upward adjustment of the retail fuel price at the pump.

In September 2020, following the last fuel price increase by the government, the NLC threatened to shut down the country with indefinite strike action to protest the decision.

However, after a preliminary agreement, a bilateral committee composed of representatives of the government and Labour was constituted with a mandate to find ways of establishing an acceptable framework for fuel pricing in the country.

Although the committee submitted its report last month to the government, there appeared to be a stalemate on the recommendations.

Labour is insisting it would not support an import-based deregulation policy, considering the high foreign exchange component in the pricing template.

Rather, they said they would want the government to repair all the four refineries in the country and made to function before contemplating the introduction of the deregulation

.