By Ari Aisen, Jesmin Rahman, and Jiaxiong Yao’

The COVID-19 pandemic has been hard on Nigeria leaving the country at a critical juncture. At the beginning, the country economic crisis worsened with the decline in the price of crude oil at the international market, which resulted in shrinking per capita income, high inflation, and governance challenges.

The government was compelled to carry out policy adjustments and reforms designed to shift the country from its dependence on oil and to diversify the economy toward private sector-led growth on a more sustainable path to recovery.

The IMF’s latest economic assessment of Africa’s largest economy recommends exchange rate reforms and strengthened efforts to increase government revenues.

What is the economic outlook for Nigeria in 2021 and beyond?

Nigeria’s recovery is expected to be weak and gradual under current policies. Real gross domestic product (GDP) growth in 2021 is expected to turn positive at 1.5 percent.

Real GDP is expected to recover to its pre-pandemic level only in 2022. The near-term outlook is subject to downside risks from pandemic-related developments with Nigeria experiencing a second wave.

Over the medium term, a subdued global recovery and decarbonization trends are expected to keep oil prices low and Organization of the Petroleum Exporting Countries (OPEC) quotas in place, restricting oil-related activities, fiscal revenues, and export proceeds.

Non-oil growth is also expected to remain sluggish, reflecting inward-looking policies and regulatory uncertainties.

How can Nigeria’s movement toward a unified exchange rate and greater flexibility help with the recovery?

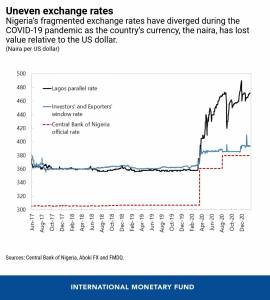

The current system creates uncertainties for the private sector because of multiple exchange rates and non-transparent rules for foreign exchange allocation.

Unifying the various rates into one market-clearing rate would establish policy credibility. Sustained premiums in the parallel market and unmet foreign exchange demand indicate the need for further adjustment in the exchange rate to reduce the gap between supply and demand.

An appropriately valued exchange rate and a clear exchange rate policy would also help instill confidence and private sector-led recovery. Policy clarity is also important to attract larger capital inflows, including foreign direct investments, which have dropped significantly in recent years and successful diversification.

How can the government raise more revenues to ensure a sustainable fiscal position?

Nigeria has one of the lowest revenue levels as a share of GDP worldwide. A large share of revenues is spent on the country’s public debt service payments, leaving insufficient fiscal space for critical social and infrastructure spending and to cushion an economic downturn.

In this context, mobilizing revenues through efficiency-enhancing and progressive measures is a top near-term priority.

Revisiting tax exemptions and customs duty waivers, increasing and broadening the base for excise taxes, developing a high-integrity taxpayer register, enhancing digital infrastructure, and improving on-time filing and payment are important measures.

Once economic recovery takes root, Nigeria will need to increase the value-added tax rate to at least 10 percent by 2022 and 15 percent by 2025—the average in countries belonging to the Economic Community of West African States—to create effective fiscal space.

Why is economic diversification important for Nigeria?

Nigeria’s export structure has not fundamentally changed over the decades, with hydrocarbon products still accounting for 90 percent of the country’s exports today as they did in the 1970s.

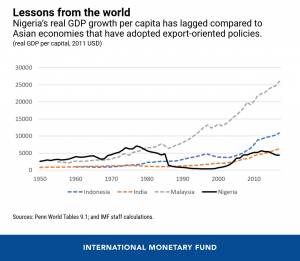

Successful economic diversification requires trade openness and competitive discipline. The experience of Malaysia, Indonesia, and to some extent India has shown that a shift toward export-oriented industrialization can boost GDP.

The limited gains from inward-oriented policies in terms of creating jobs and improving living standards suggest that Nigeria needs to change course.

To accommodate a growing number of young people entering the labor market, Nigeria will need to create at least 5 million new jobs each year over the next decade.

Based on experience of other countries, embracing more open trade and competition policies would help diversify the economy and reinvigorate growth, particularly as the African Continental Free Trade Area takes effect.

What transparency measures has Nigeria put in place to ensure emergency spending is going toward its intended use?

The authorities have adopted measures to facilitate tracking and reporting of emergency spending. The government has created new budget lines with monthly expenditure information on emergency funding, which are posted on the Ministry of Finance’s Transparency Portal, although users have found it difficult to access the data.

The Bureau of Public Procurement has issued guidelines on COVID-19 emergency fund use, and the Nigeria Open Contracting Portal has been publishing related procurement contracts, although some contract details on beneficiary ownership are yet to be completed.

Going forward, Nigeria needs to further embrace transparency reforms by expanding the monitoring and reporting of all public spending, as well as ensuring easy public access to spending data.

Ari Aisen, Jesmin Rahman, and Jiaxiong Yao’ are IMF Staff, African Department in Washington