The Federation Accounts Allocation Committee (FAAC) on Wednesday announced it shared a total of N619.343billion as allocation to the three tiers of government from the federation account for December, 2020.

The three tiers of government consist the Federal and 36 States and 774 Local Governments of the federation.

The announcement was made at the end of the virtual meeting of the FAAC in Abuja.

The FAAC Secretariat report showed that the total allocation for the month included cost of collection to Nigeria Customs Service (NCS), Department of Petroleum Resources (DPR) and Federal Inland Revenue Service (FIRS).

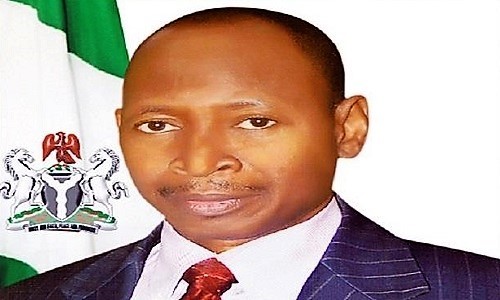

The report presented by the Accountant of the Federation, Ahmed Idris , showed distributed Statutory Revenue of N437.256 billion received for the month.

Mr Idris said the figure was higher than the N436.457billion received for the previous month by N0.799 billion.

The communique issued at the end of the meeting showed that the gross revenue available for distribution included N171.358 billion from the Value Added Tax (VAT) collection for December, 2020 against N158.785 billion distributed in the preceding month of November, 2020, an increase of N14.572 billion.

Regardless, the distributable figure was still below the agreed threshold , resulting in the figure being augmented with about N6.897 billion and N3.482 billion drawn from Foreign exchange Equalisation Account and Exchange Gain Difference respectively.

Details of the revenue allocation for the month included the Federal government N189.451 billon, States N96.092 billion, Local Government Councils N74.083 billion.

Derivation revenue allocation (13% Mineral Revenue) to the nine oil producing states of the Niger Delta region included N30.477 billion and Cost of Collection/Transfer and Refund got N47.152billion.

The communique also revealed that Companies Income Tax (CIT), and Oil and Gas Royalty paid by the oil joint venture operators increased significantly, while Value Added Tax (VAT) recorded some considerable increase.

On the other hand, import and excise duties decreased marginally, while Petroleum Profit Tax (PPT) declined substantially.

The balance in the Excess Crude Account as at January 20, 2021 stands at $72.411 million.

The distribution of the allocation for the months showed that the Federal Government received N218.297 billion, the States N178.280 billion, the Local Government Councils got N131.792 billion, while the oil producing states received N31.827 billion as derivation (13% of Mineral Revenue) and Cost of Collection/Transfer and Refunds got N59.147billion.

The VAT distribution showed that the Federal Government got N23.904 billion; States N79.682 billion, and Local Government Councils N55.777 billion.

Cost of collection for FIRS and NCS stood at about N6.854 billion and Allocation to North East Development Commission (NEDC) project received N5.141 billion.