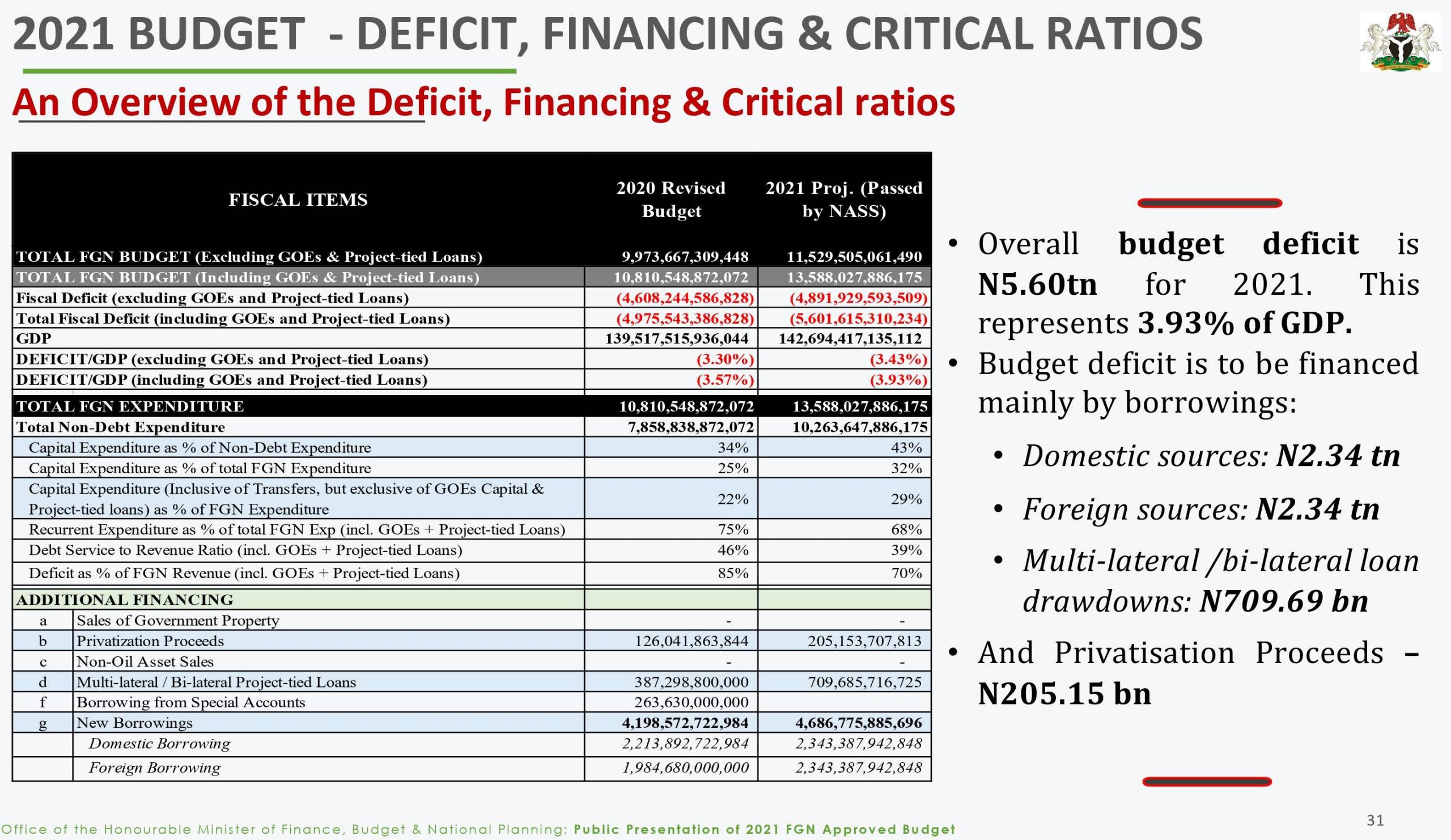

The Federal Government said on Tuesday the N5.6trillion deficit in the 2021 Budget would be financed mainly from domestic and foreign borrowings, loans and proceeds from the privatization of public assets.

The Minister of Finance, Budget and National Planning, Zainab Ahmed, said the government plans to borrow about N2.34trillion each from domestic and foreign sources, with about N709.69 billion expected from multilateral and bilateral loan drawdowns and N205.15 billion from privatization proceeds.

The Minister gave the explanation in Abuja during a virtual media briefing to give details to the provisions in the Appropriation Act signed by President Muhammadu Buhari on December 31, 2020.

The Minister said the total fiscal deficit, including government-owned enterprises and project-tied loans, represents about 3.93 percent of the country’s aggregate value of goods and services for the year, also known as gross domestic product (GDP).

Although the percentage deficit exceeds the 3 per cent of GDP approved by the Fiscal Responsibility Act 2007, the Minister said the law permits the government to exceed that level in difficult situations, like current pressures on the economy as a result of the impact of COVID-19.

Details of the deficit in the fiscal items showed fiscal deficit, excluding government-owned enterprises (GOEs), and project-tied loans at about N4.89trillion, from N4.61 trillion in the revised budget for 2020.

Details of the deficit in the fiscal items showed fiscal deficit, excluding government-owned enterprises (GOEs), and project-tied loans at about N4.89trillion, from N4.61 trillion in the revised budget for 2020.

Fiscal deficit, including GOEs and project-tied loans, stood at about N5.6trillion, from N4.98trillion last year.

With GDP at N142.69 trillion, from N139.52trillion in 2020, the minister said the deficit GDP, excluding GOEs and project-tied loans, was 3.43 percent against 3.30 percent in the previous year.

Deficit GDP, including GOEs and project-tied loans is about 3.93 percent, compared to 3.57 percent last year.

Total revenue, including from GOEs, is about N7.99trillion, about 36.9 percent higher than the 2020 projection of N5.84 trillion.

The minister said aggregate projected revenues would be 30 percent from oil-related sources while 70% would come from non-oil sources, in line with the government decision to de-emphasize reliance on oil. expected to be available.

Total Federal Budget, excluding GOEs and project-tied loans was given as N11.53trillion, while total Federal Budget, including GOEs and project tied loans is about N13.59trillion;

Total amount available for the budget approved by the National Assembly, excluding GOEs revenues, stands at about N6.64 trillion

The amount consists share of oil revenue (N2.01 trillion), Share of dividend from Nigeria LNG (N208.54billion), Share of minerals and mining revenue (N2.65billion).

Share of non-oil revenue of N1.49trillion is made up of share of company income tax (N681.7 billion); VAT (N238.43 billion); Nigeria Customs Service (N508.37 billion); share of Federation Accounts levies (N60.51billion).

Also, revenue from government owned enterprises stands at about N2.17trillion, although there was a loss of about N825.02 billion report as a result of their inability to return to the government operating surplus from 80 percent captured in independent revenue.

During the year, Independent revenues was expected to be about N1.06triilion; transfers from special levies account (N300billion); signature bonus/renewals/early renewals oil companies operating in the country and new oil licenses to be issued during the year (N677.02billion); domestic recoveries, assets, fines (N32.68billion); Stamp duty (N500billion), and grants and donor funding (N354.9billion).

During the year, Independent revenues was expected to be about N1.06triilion; transfers from special levies account (N300billion); signature bonus/renewals/early renewals oil companies operating in the country and new oil licenses to be issued during the year (N677.02billion); domestic recoveries, assets, fines (N32.68billion); Stamp duty (N500billion), and grants and donor funding (N354.9billion).

With aggregate expenditure (inclusive of GOEs and project-tied Loans) is put at about

N13.59 trillion, which is 25.7 percent higher than the revised 2020 Budget, with recurrent (non-debt) spending, estimated to about to N5.99trillion, about 44.1% of total expenditure, and 13.3 percent higher than the 2020 revised estimates, reflecting increases in salaries & pensions.

The expenditure also includes aggregate capital expenditure of N4.37trillion, about 32.2 percent of total expenditure; and 62.9 percent higher than the 2020 Revised Budget (inclusive of Capital component of Statutory Transfers, GOEs.

Also, capital & project-tied loans expenditures is about N3.32trillion; debt service 24.5 percent of total expenditure, and 12.6 peer’s cent age higher than 2020 revised Budget.

Also, capital & project-tied loans expenditures is about N3.32trillion; debt service 24.5 percent of total expenditure, and 12.6 peer’s cent age higher than 2020 revised Budget.

Provision to retire maturing bonds to local contractors/suppliers of N200 billion is 1.68% of total

expenditure. This reflects FGN’s continuing commitment to offset accumulated arrears of

contractual obligations dating back over 10 years.

On crude oil, the minister said the budget was based crude oil benchmark price of $40 per barrel per barrel, with crude oil production expected to increase from 1.8million barrels in 2020 to 1.86 million barrels in 2021

Although Nigeria has the capacity to produce up to about 2.5m barrels per day, current production would be limited to 1.7million barrels per day, including 300,000 barrels of condensate in compliance with OPEC quota restriction.

Oil GDP is projected to rise by 16.23percent during the year, year on year, with about 1.1 percent increase in non-oil GDP.